Home and Garden Consumer Survey 2024

How do UK consumers prefer to buy when it comes to home and garden products? Great question. And one we didn’t have the answer to.

We asked 2000 consumers six questions about their shopping habits, attitudes and priorities when it comes to home and garden purchases to find out. So if you’re in the business of selling chic furniture, or exotic plants, or anything under the home and garden umbrella, you’ll find these insights invaluable.

Keep reading to find out these six home and garden consumer trends you need to know, plus 5 key actionable tips.

How has COVID-19 impacted online shopping?

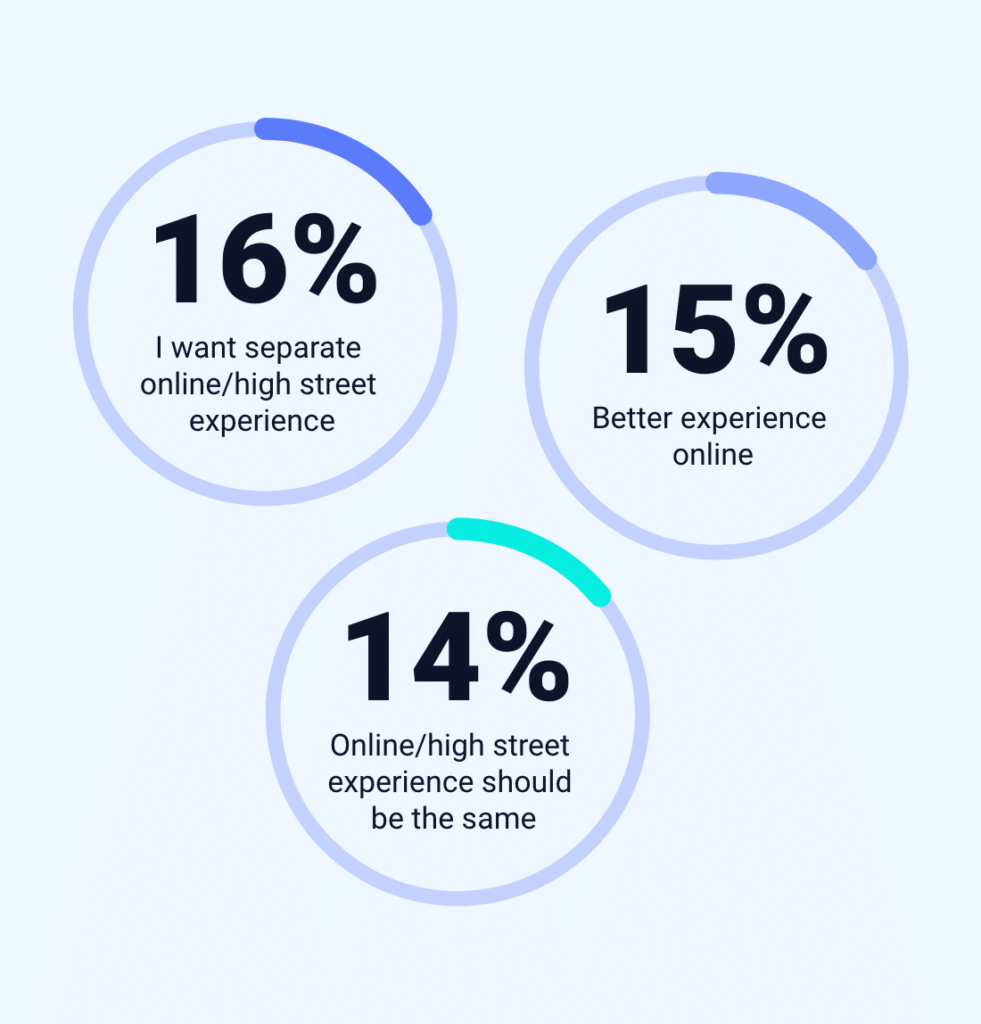

The first question in our survey asked participants to compare their online and in-store shopping experiences for home and garden products pre and post COVID. The responses indicate a diverse range of preferences and experiences among consumers, with no single experience dominating.

- 15% of respondents believe brands offer a better experience online.

- 14% prefer the in-store experience.

- Another 14% express a need for brands to harmonize their online and high-street experiences.

- 16% prefer distinct online and high-street experiences.

What does this mean for retailers?

These results present a complex picture. It’s clear that there is no one-size-fits-all approach to retail in the home and garden sector. Retailers must be agile, adaptable, and customer-focused to succeed in this diverse market.

For the 15% who believe that brands provide a better online experience, retailers must continue investing in their digital platforms. This includes ensuring a seamless user interface, providing comprehensive product information, and offering efficient delivery options.

The 12% who see no difference between online and in-store experiences represent an opportunity for brands to distinguish themselves. By enhancing either or both experiences, retailers can win over these consumers. Yet there’s also a statistically significant 14% who want a consistent online and high-street experience, highlighting the need for omnichannel retailing.

Key takeaway: Brands should strive for consistency across all platforms, delivering a unified brand message and shopping experience.

Where do UK consumers prefer to shop for home and garden products?

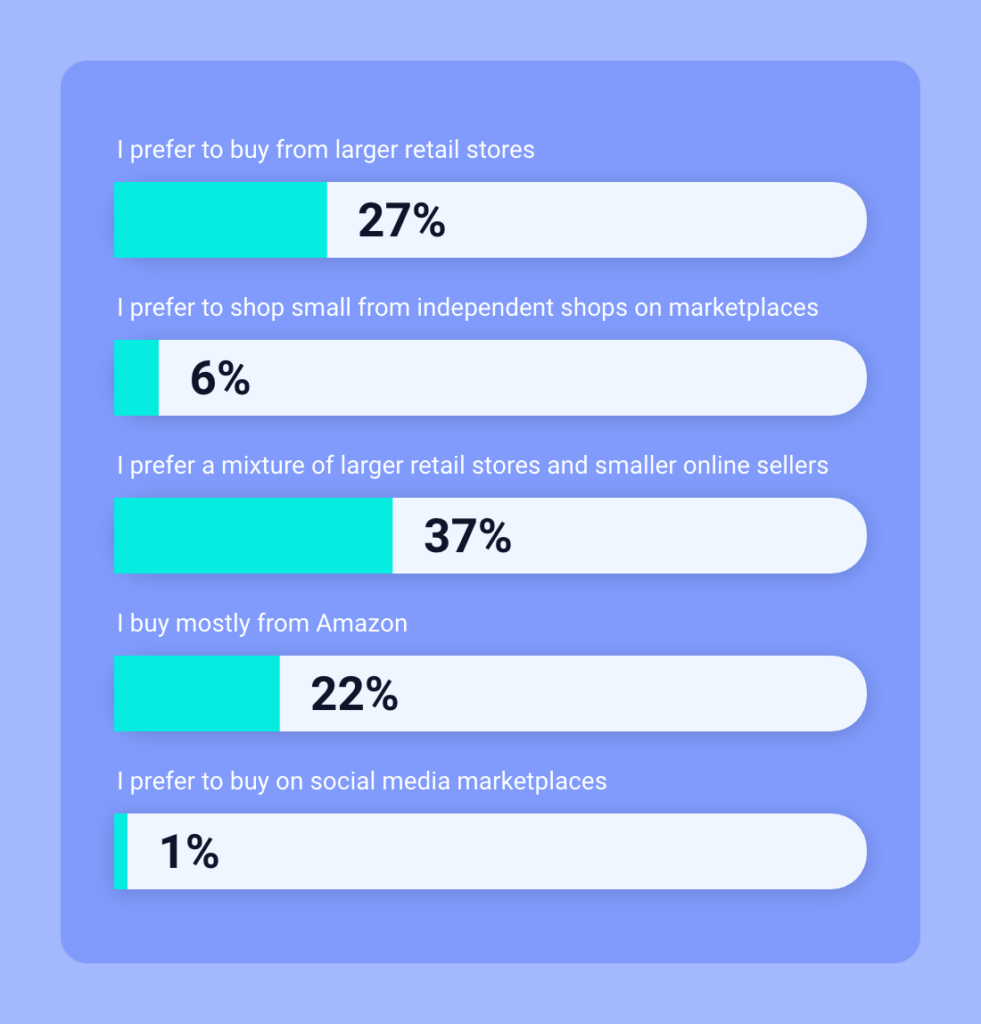

The next question on our survey explored consumers’ shopping preferences, specifically where they prefer to shop online for home and garden products. Once again, the results suggest a diverse range of preferences, reinforcing the need for retailers to understand their target market and tailor their offerings accordingly.

- 27% of respondents prefer to buy from larger retail stores such as B&Q, Homebase, or John Lewis.

- A small 6% prefer to shop from independent shops on marketplaces like Etsy or Not on the High Street.

- The majority, 37%, prefer a mixture of larger retail stores and smaller online sellers.

- 22% mostly buy from Amazon.

- Only 1% prefer to buy on social media marketplaces

What does this mean for retailers?

The majority of respondents (37%) prefer a mixture of larger retail stores and smaller online sellers when shopping for home and garden products. This suggests that consumers value diversity in their shopping experiences, seeking a balance between the reliability and variety of larger retailers and the unique, artisanal offerings of smaller sellers. It implies that both large-scale retailers and smaller vendors have significant roles to play in the market.

Interestingly, only 1% of respondents prefer to buy on social media marketplaces. Despite the recent surge in social commerce, it appears that when it comes to home and garden products, consumers are sticking to more traditional online platforms. This could be due to various factors, including trust, ease of returns, or simply the type of products typically available on these platforms.

The data shows that Amazon continues to hold a significant share of the market, with 22% of respondents primarily shopping there. This emphasises the continued dominance of Amazon in the online retail space and its power to shape consumer shopping habits.

Key takeaway: The findings emphasize the importance of understanding where consumers prefer to shop and ensuring that products are readily available and easily accessible on those platforms.

Has the cost of living crisis impacted customer attitudes?

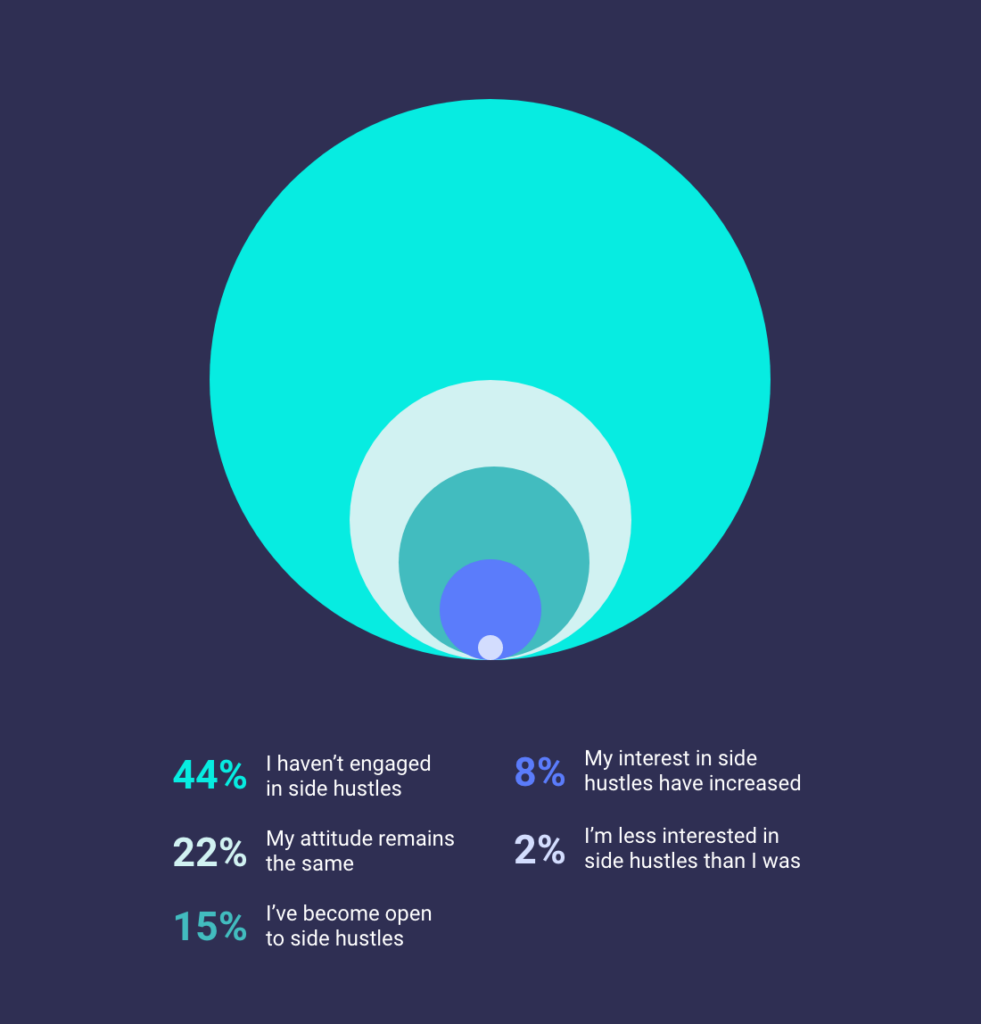

How have the pandemic and the recent cost of living crisis impacted consumer attitudes towards side hustles, particularly upcycling, in the UK? This was the focus of the third question in our home and garden trends survey. The results provide a fascinating insight into how external factors influence our shopping habits and our engagement with alternative methods of acquiring products.

- 8% of respondents have seen their interest in side hustles, especially upcycling, significantly increase due to the pandemic and cost of living crisis.

- 15% are more open to side hustles like upcycling due to the challenges brought on by these factors.

- 22% maintain the same attitude towards side hustles, irrespective of the current situation.

What does this mean for retailers?

While a significant portion (44%) of respondents has not engaged in side hustles or upcycling, indicating that traditional shopping methods still dominate for home and garden products, there is a noticeable shift towards these alternative approaches.

23% of respondents have either significantly increased their interest in or become more open to side hustles like upcycling due to the pandemic and the rising cost of living. This suggests that economic pressures are encouraging a subset of consumers to explore alternative, potentially more cost-effective ways of acquiring home and garden products.

However, it’s worth noting that the majority (22%) remain unaffected in their attitudes towards side hustles, indicating a resilience or perhaps satisfaction with their current shopping habits.

Key takeaway: The consumer landscape fluctuates in response to external pressures. Retailers need to be aware of these shifts as they could open up new opportunities for reaching and engaging with consumers in different ways.

How do consumers buy home and garden products?

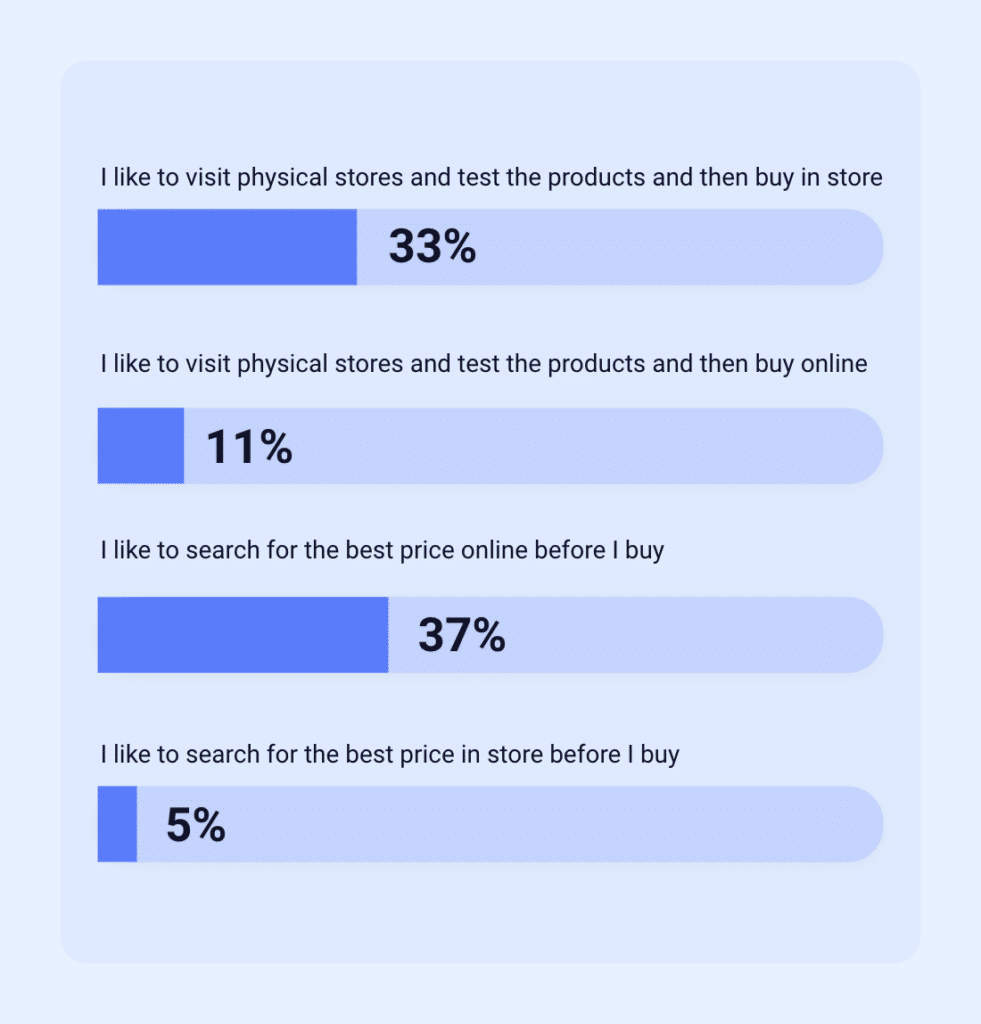

How do consumers typically navigate their buying journey when it comes to home and garden products? The fourth question in our home and garden trends survey sheds light on these preferences, revealing pivotal insights into how people prefer to shop in an increasingly omnichannel retail environment.

- 33% of respondents like to visit physical stores, test the products, and then make their purchase in-store.

- 11% prefer to visit physical stores and test the products, but then proceed to buy online.

- The majority, 37%, like to search for the best price online before making a purchase.

- A small 5% prefer to search for the best price in-store before buying.

What does this mean for retailers?

The data reveals a clear trend towards online shopping, with 37% of respondents preferring to search for the best price online before they buy. This illustrates the importance of competitive pricing and the impact of cost-conscious consumers in the digital marketplace. Retailers need to ensure they’re offering value for money, as many customers are willing to invest time in finding the best deal.

Interestingly, a significant portion (33%) of respondents still prefer the traditional route of visiting physical stores, testing products, and then buying in-store. This suggests that despite the rise of e-commerce, brick-and-mortar stores continue to play a crucial role in the customer buying journey, particularly when it comes to home and garden products where tactile experience can be important.

The 11% who visit physical stores to test products but then buy online indicate a growing trend of showrooming – where customers use physical stores to decide what to buy, but make the actual purchase online, often at a lower price. This highlights the need for retailers to create a seamless and integrated omnichannel experience.

Key takeaway: These results demonstrate the enduring value of in-person retail experiences alongside the need for a competitive online presence, highlighting the importance of a balanced omnichannel strategy for home and garden retailers to meet the diverse preferences of consumers.

What matters most to consumers when shopping for home and garden products?

What are the most significant factors that consumers consider when shopping for home and garden products? The fifth question in our home and garden trends survey provides key insights into what truly matters to customers in their purchasing decisions.

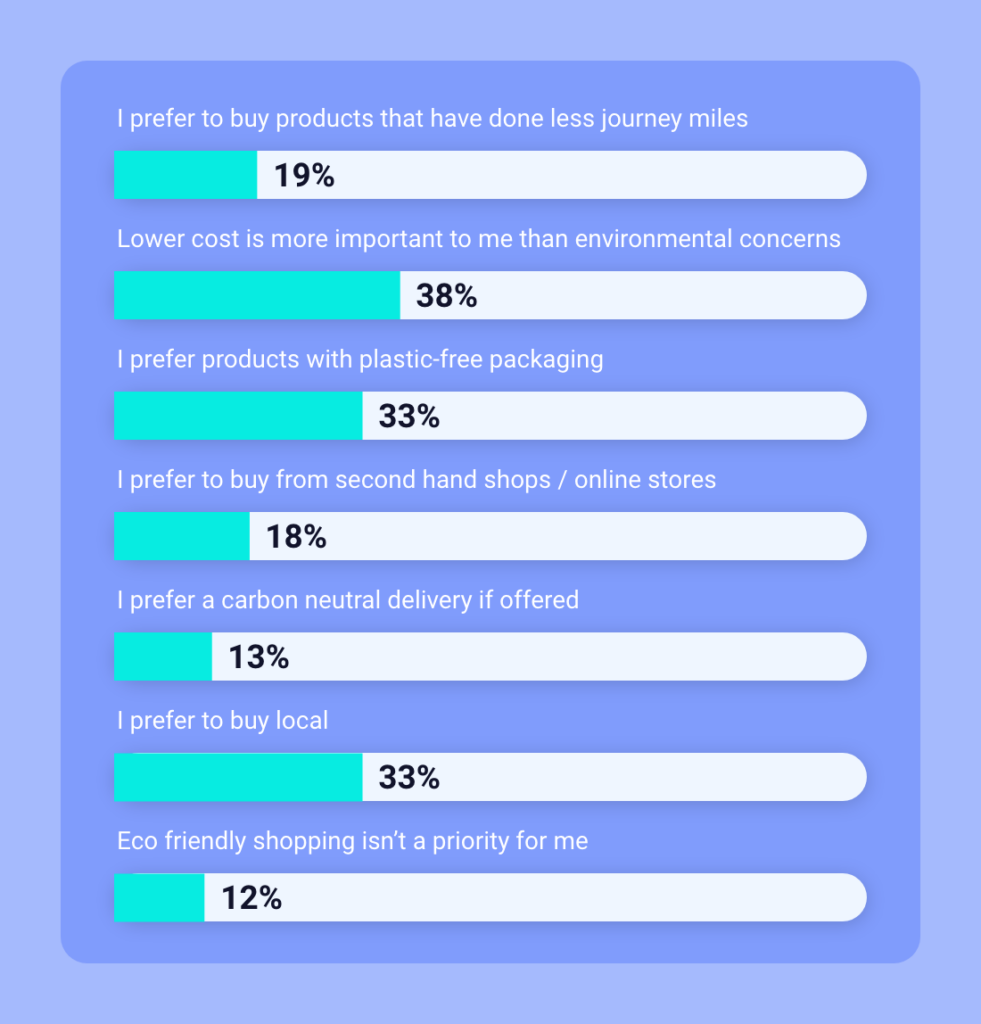

- 19% prefer to buy products that have done fewer journey miles.

- The majority, 38%, say lower cost is more important to them than environmental concerns.

- 33% prefer products with plastic-free packaging.

- 18% prefer to buy from second-hand shops or online stores.

- 33% prefer to buy local.

What does this mean for retailers?

The survey results reveal interesting trends about the importance of cost, sustainability, and locality in modern consumer behavior.

Cost is evidently a major factor for many consumers, with 38% stating that lower cost is more important to them than environmental concerns. This finding suggests that while sustainability is growing in importance, it may still be secondary to economic considerations for a substantial portion of consumers.

However, the environment is clearly a concern for many, with 33% preferring plastic-free packaging and another 33% opting to buy local. Moreover, 19% prefer products that have traveled fewer miles, indicating an awareness of the environmental impact of transport. These findings highlight the increasing importance of sustainability in consumer preferences, and the need for retailers to consider these factors in their product offerings and supply chain management.

Interestingly, 18% of respondents prefer to buy from second-hand shops or online stores, suggesting a growing market for pre-loved items. This is being driven primarily by environmental factors as consumers look to become more sustainable. But second-hand shopping is also cheaper, which is the what matters most to UK consumers.

Key takeaway: There is a fascinating interplay between cost and eco-consciousness that is shaping modern shopping habits, with a notable trend toward preferring locally sourced, plastic-free options despite the dominant cost consideration. On top of this, the continued rise of second-hand marketplaces demonstrates a significant shift towards more sustainable consumption practices.

Which online marketplaces do consumers use?

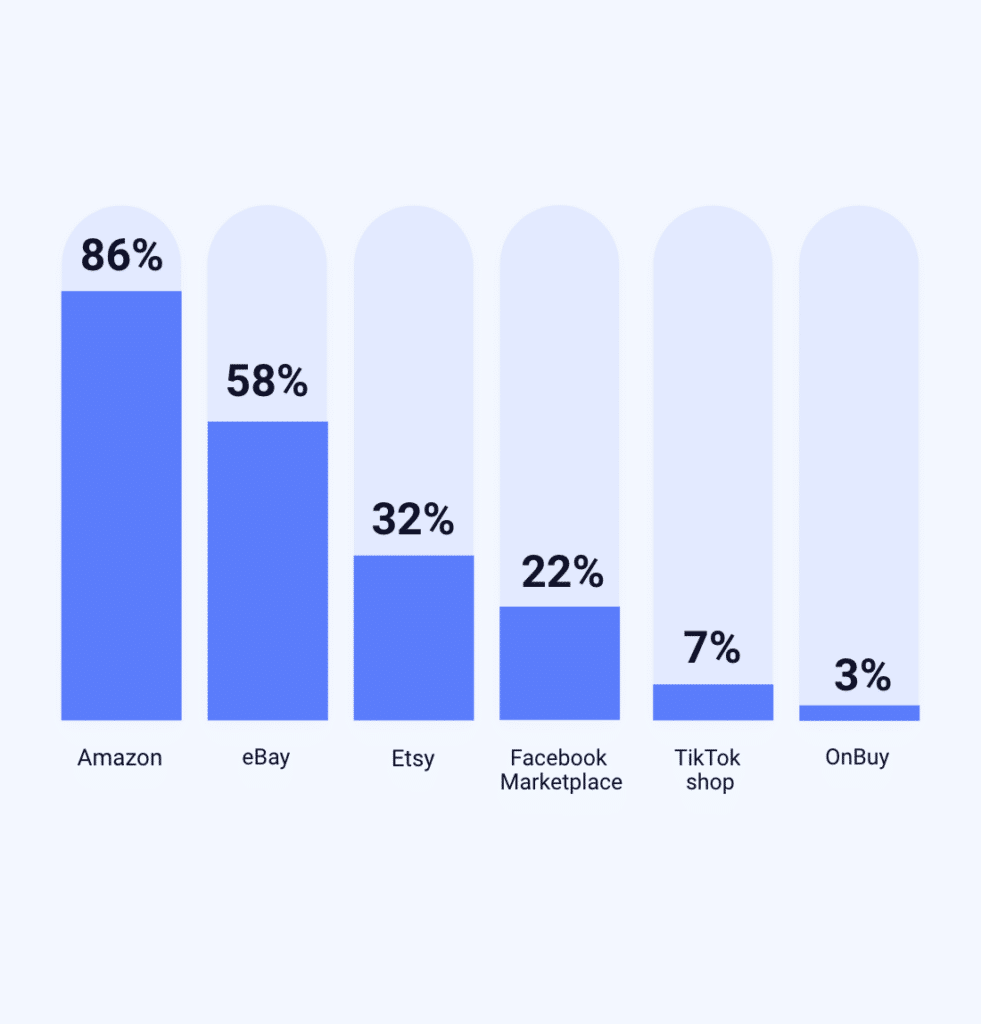

UK shoppers have a wide selection of marketplaces for home and garden items. Up next in our survey, we explore the leading ecommerce sites for home and garden shopping and how they cater to consumer needs. Despite dominant players, we also see the emergence of niche platforms in the home and garden sector.

What does this mean for retailers?

No prizes for guessing that Amazon came out on top here, with an overwhelming 86% of respondents using the platform for shopping. Amazon’s vast selection, competitive pricing, and Prime shipping as key factors in its success.

However, other platforms also hold significant market share. eBay is used by 58% of respondents, indicating its continued relevance in the face of intense competition. Etsy, known for unique handmade and vintage items, is used by 32%, highlighting the demand for specialized products.

Surprisingly, newer entrants like TikTok Shop have relatively low usage, with just 7% of respondents using the platform. This could be due to its recent introduction or possibly a lack of awareness among consumers. Meanwhile, Facebook Marketplace has etched out its territory as a second-hand marketplace with one in five consumers opting to shop within the social networking site.

Key takeaway: The data clearly illustrates that while Amazon maintains a stronghold in the home and garden sector, there is a notable consumer appetite for the specificity and uniqueness offered by platforms like eBay and Etsy. This implies an opportunity for sellers on niche marketplaces to grow.

5 actionable tips for home and garden retailers to succeed in 2024

Our survey has highlighted critical areas for home and garden retailers to focus on in order to remain competitive and successful in 2024. By taking note of these insights into actionable strategies, retailers can build stronger relationships with consumers and stand out in a crowded market.

Here are five actionable tips for home and garden retailers to takeaway:

- Embrace omnichannel retailing: Consumers expect the convenience of shopping both online and in-store. Develop an integrated shopping experience that allows customers to seamlessly switch between the two, offering features like online product testing or in-store pick-up for online purchases.

- Competitive pricing: With cost being a significant factor for many consumers, implement competitive pricing strategies while maintaining quality. Consider value-based pricing, price matching, and loyalty programs to retain price-conscious customers.

- Prioritize sustainability: Given the consumer preference towards eco-friendly options, incorporate sustainability into your business model. This includes offering products with plastic-free packaging, sourcing local products, and providing options that reduce the environmental impact of transport.

- Expand second-hand offerings: Capitalize on the growing market for second-hand goods by offering pre-loved home and garden items. Create a section for refurbished or vintage products alongside new goods to provide a more sustainable and cost-effective choice for shoppers.

- Diversify your online presence: While Amazon dominates in terms of usage, don’t neglect niche marketplaces like Etsy and eBay that cater to consumers’ desire for unique products. Connected CommerceOps platforms like Linnworks make connecting to multiple marketplaces easy.

Take the next steps to improve marketplace connectivity for ecommerce retailers

In a market shaped by consumer emphasis on cost, convenience, and sustainability, technology becomes a critical ally for home and garden retailers aiming to thrive. The survey underscores a clear trend: the future of retail is digital, and Linnworks sits at the core of this transformation.

Linnworks offers essential capabilities to retailers seeking efficiency and growth:

- Connectivity: Linnworks offers unparalleled connectivity, allowing retailers to tap into a broad spectrum of marketplaces, including big names like Amazon and eBay, as well as niche platforms like Etsy. This wide-reaching connectivity is pivotal for retailers who are looking to target a diverse consumer base and expand their online presence effectively.

- Automation: The platform stands out for its robust automation capabilities, which streamline and expedite many of the traditionally labor-intensive ecommerce processes such as listing products, managing stock, processing orders, and handling shipments. This automation not only saves precious time for retailers but also reduces the likelihood of human error, ensuring a smooth operation.

- Centralization: Linnworks acts as a centralized hub, giving retailers a comprehensive overview and control of their listings, inventory, orders, and shipping processes all from one dashboard. This integration is crucial for maintaining consistency across various channels, keeping track of stock levels, and providing seamless customer experiences.

As consumers continue to prioritize convenience, cost and eco-conscious purchasing, Linnworks provides the technological infrastructure needed to meet, and even exceed, these evolving demands.

But don’t just take our word for it. Request a demo and see for yourself how Linnworks can connect, automate and scale your ecommerce operations by setting up a solid foundation for your business. Alternatively, if you have any queries or need further information, please feel free to reach out to us via our contact page.