Linnworks State of Commerce Ops Report

What are the biggest commerce trends of 2024?

2024 is shaping up to be an exciting year for online retailers. Nearly half of all retailers are gearing up to broaden their horizons into new channels and marketplaces.

But do these companies possess the operational connectivity to provide exceptional customer experiences and meet rising demand as they scale?

Linnworks surveyed over 2,000 consumers and 1,000 ecommerce retailers to create the most comprehensive analysis of the priorities and challenges both consumers and retailers are facing in 2024.

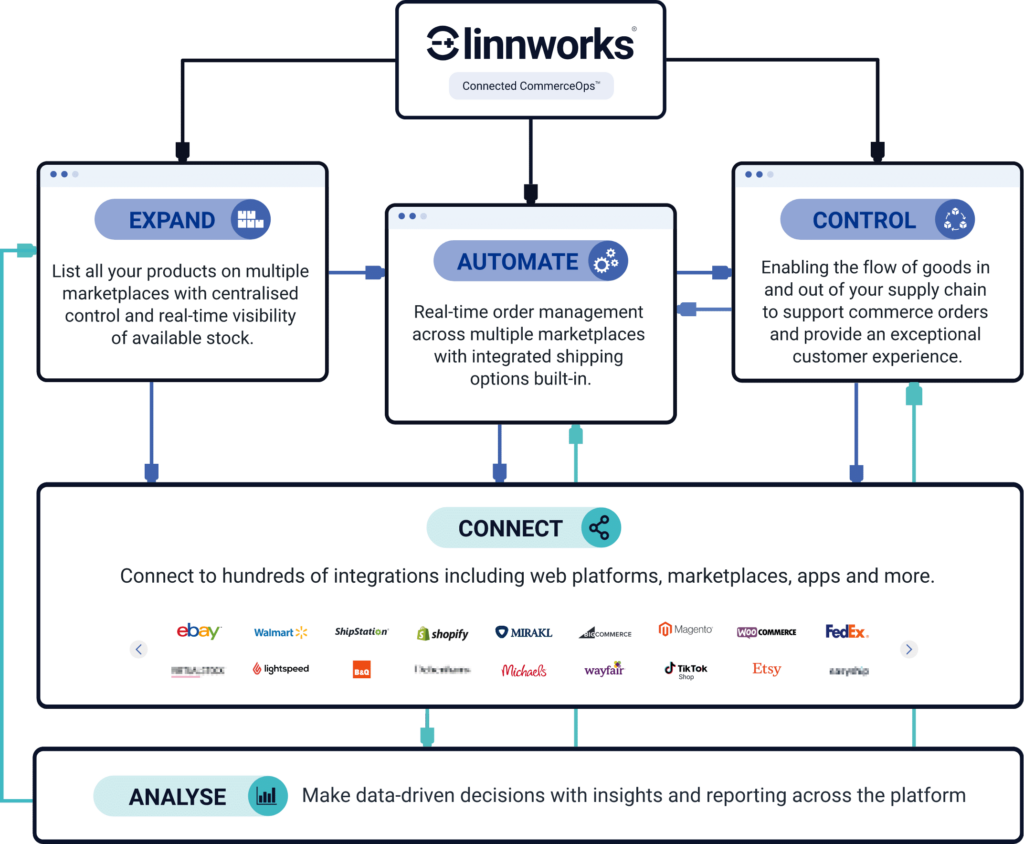

Our research shows that to work through these challenges, retailers need to aim for a connected commerce operation:

- Connecting to new marketplaces and shipping couriers with ease

- Automating time-consuming tasks like inventory and order processing

- Centralizing order, inventory, listing, and shipment management.

Keep reading to find out the biggest consumers and retailer trends of 2024.

Note: The State of Commerce Ops Report is sponsored by ShipStation and Virtualstock. It was conducted on behalf of Linnworks by OnePoll in January 2024.

Consumers are gravitating towards online marketplaces for their shopping needs, with a strong emphasis on getting the best value for their money, free shipping, and hassle-free returns. Interestingly, next-day delivery is no longer a top priority.

Small to mid-sized retailers are keen to meet these evolving consumer expectations, but operational inefficiencies are holding them back. The persistent reliance on spreadsheets and disjointed back-end systems often fail to provide a solid foundation for companies looking to seize growth opportunities.

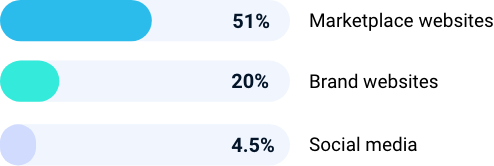

1. Marketplaces are the leading sales channel

51% of consumers said marketplace websites, such as Amazon and eBay, were their favorite places to shop, followed by brand websites at 20% and social media at 4.5%.

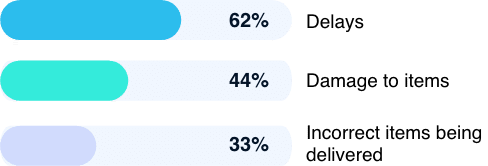

2. Shipping delays and damaged items are biggest complaints

Delays (62%), damage to items (44%) or incorrect items being delivered (33%) were consumers’ biggest issues when it comes to shipping.

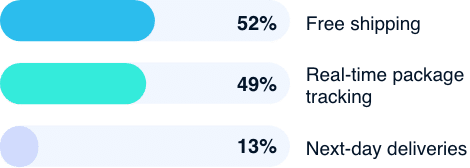

3. Shoppers want free shipping and free returns

Free shipping (52%) and real-time package tracking (49%) is the biggest expectation when it comes to shipping. Next-day deliveries, not so much (13%).

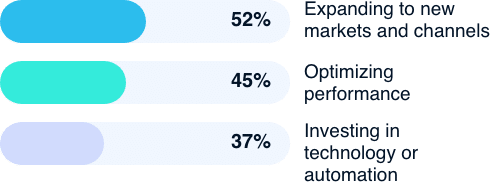

4. Expanding to new markets and channels is the number one goal

52% of retailers state their number one goal is to grow. Expanding to new markets and new channels is their top priority. Optimizing performance on existing sales channels (45%) comes next.

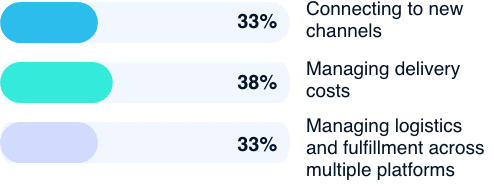

5. Shipping costs and connecting to new marketplaces providing major challenge

Despite the desire to expand to new channels, 33% of online retailers say that connecting to them is one of their biggest operational challenges alongside managing delivery costs (38%).

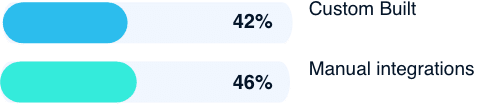

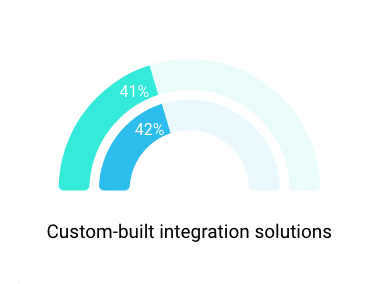

6. Retailers are still relying on custom and manual integrations

A significant number of online retailers are still relying on custom-built (42%) and manual integrations (46%) to link their operations to marketplaces.

Retailers want to

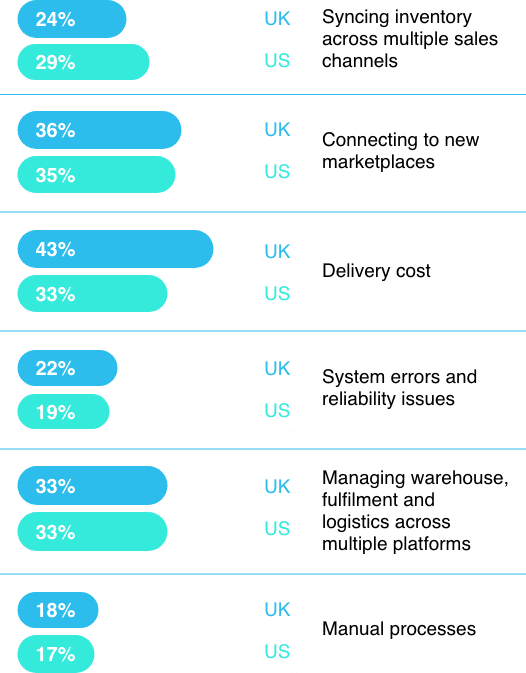

1. Shipping costs and connectivity are major challenges

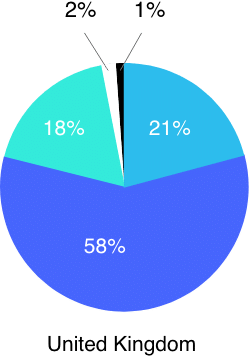

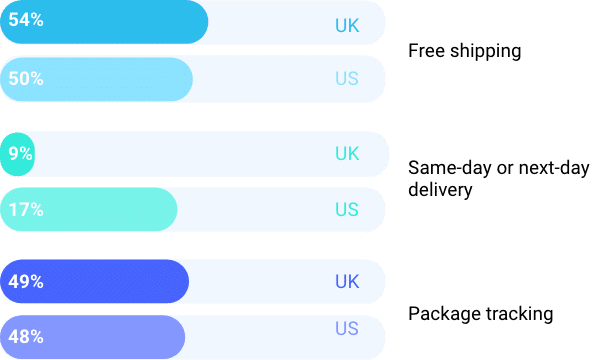

UK (43%) and US online retailers identified managing delivery costs (33% of respondents) and connecting to new marketplaces (36% for UK, 35% for US) as the main operational challenges during business growth. These concerns align with consumers' top issue - delivery cost.

Other significant retailer pain points include coordinating warehouse, fulfillment, and logistics across various platforms, and syncing inventory across multiple channels.

Takeaway: Online retailers need to reduce their shipping costs and use the right technology to reach new markets easily. It's important to connect all parts of their system for a complete look at their business.

What are the top operational challenges you experience as your business grows and complexity increases?

When considering an efficient commerce operation, integration is key. The goal is a seamless flow of capabilities to sell into various marketplaces.

First, there's access to channels. It's about the ecosystem that allows selling wherever customers can be found. From eBay to Walmart to Amazon, our integrations let our customers conduct their business smoothly.

Second, it's about the ability to execute logistics. Many online sellers might not have a logistics infrastructure or warehouses and may have inventory scattered globally. Our ability to connect with all these channels and partners drives a seamless process, enabling our sellers to grow their businesses efficiently.

Chris Timmer

CEO, Linnworks

2. Mid-market retailers are investing in inventory visibility

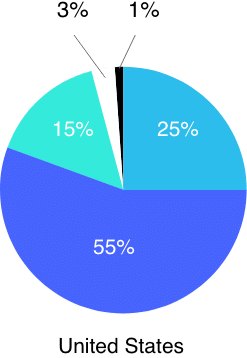

Retailers with higher revenues, likely due to more available investment, have superior inventory visibility across their sales channels and warehouses.

Four out of five UK firms with a turnover between $1M and $50M reported ‘good’ or ‘excellent’ visibility, closely followed by US retailers within the same revenue range. This underscores the significance of inventory visibility as businesses grow.

Takeaway: As retailers scale, investing in superior inventory visibility becomes crucial. It not only helps to streamline operations but also improves efficiency, leading to greater customer satisfaction and potentially higher revenues.

How would you describe the visibility of inventory across your sales channels and warehouses?

3. Retailers are powering ahead with process automation

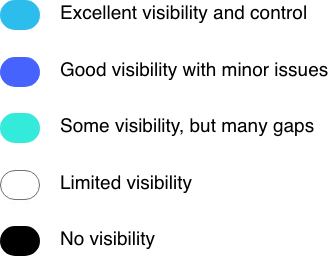

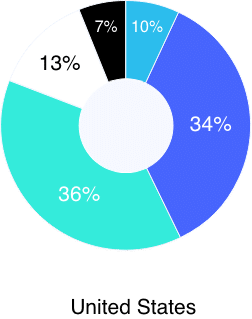

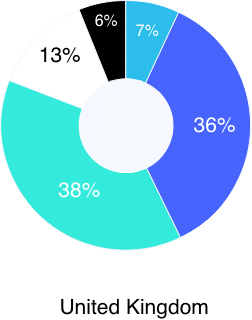

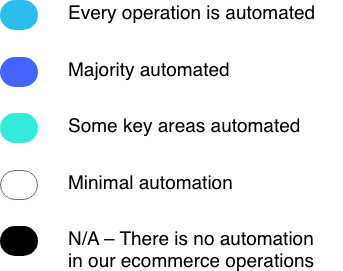

Automation is becoming essential for retailers to scale sustainably and cost-effectively. While only a few industry pioneers in the UK (7%) and US (10%) have fully automated operations, over a third of retailers in both countries have automated significant parts of their business.

Businesses generating between $1M and $10M revenue show the highest automation rates, with 49% in the UK and 51% in the US. Approximately one in five of firms still have minimal or no automation in their ecommerce operations.

Takeaway: There is a big opportunity for retailers to stand out by embracing automation. It not only improves operational efficiency but also offers a competitive edge, especially for those yet to adopt this technology.

How much of your ecommerce operations involve automation?

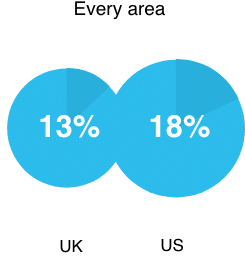

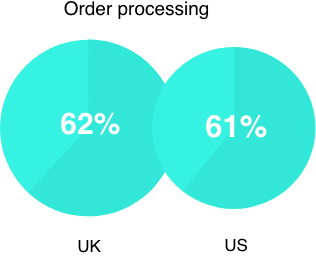

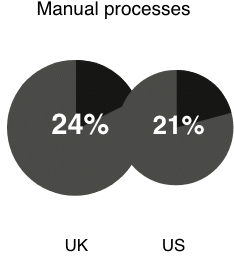

4. Inventory and order automation comes first

Ecommerce businesses are focusing their automation efforts on order processing and inventory management. More than 60% of retailers in both the UK and US have automated their order processing, while approximately half have optimized inventory management. Firms with revenue between $500,000-$1M and $10M-$50M are leading in this domain.

Automating manual ecommerce processes is the third most common area, with around a fifth of US respondents and a quarter of UK respondents prioritizing this. Successful firms view automation as an ongoing, organization-wide initiative, not just an isolated effort.

Takeaway: To enhance efficiency and productivity, retailers should consider automating key areas such as order processing, inventory management and manual ecommerce processes. Viewing automation as a continuous, organization-wide effort can lead to more significant benefits and success.

How much of your ecommerce operations involve automation?

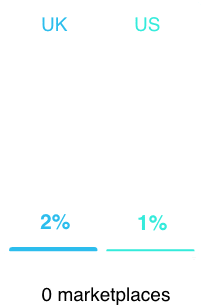

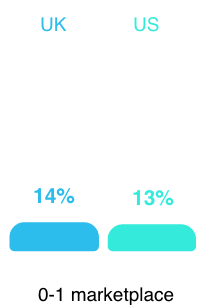

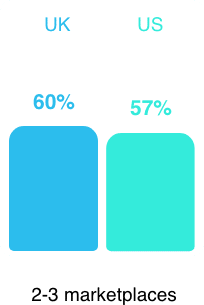

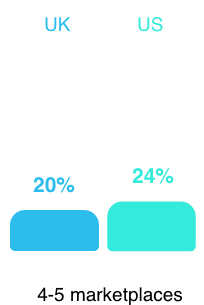

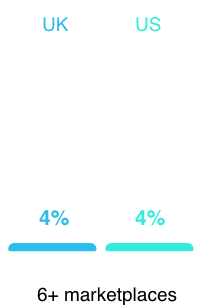

5. Two to three marketplaces is the sweet spot

Most firms (74% in the UK and 70% in the US) sell their products on one to three marketplaces such as eBay, Amazon, and Etsy. However, about a quarter (UK 24% and US 28%) expand their reach by selling through four or more marketplaces.

Nearly half of US firms (47%) and over a third (35%) of UK firms with revenues exceeding $10M target more than four marketplaces. Generally, retailers with higher revenues tend to sell on more marketplaces.

Takeaway: Expanding sales across multiple marketplaces can be an effective strategy for growth. The data suggests that higher-revenue retailers often use this approach, highlighting its advantages for reaching more customers.

How many online marketplaces do you currently sell on?

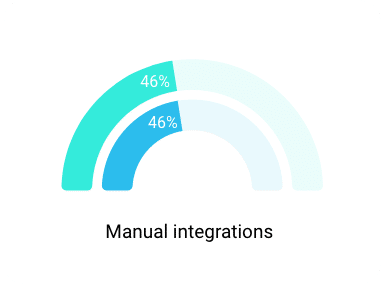

6. Smaller retailers are relying on manual integrations

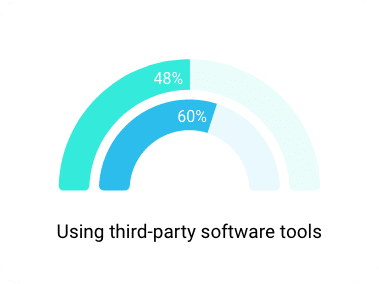

A large portion of online retailers still use custom-built or manual integrations to connect their operations to marketplaces. Approximately 40% of retailers in both the UK and US use custom solutions, and nearly half (46%) use manual integrations.

48% of UK and 60% of US retailers use third-party software tools. Notably, the higher a retailer’s revenue, the more likely they are to use third-party tools – with 71% of US and 60% of UK retailers earning over $10M doing so.

Takeaway: Retailers can reap huge benefits from using third-party software tools for marketplace integration. These tools can possibly make operations smoother, enhance efficiency, and foster growth.

How do you integrate online marketplaces into your operations?

Custom-built solutions achieve greater integration control and flexibility but require extensive planning and resources. Whereas retailers using manual integrations likely face limitations due to inadequate IT infrastructure for managing multichannel shopping experiences. Adopting out-of-the-box solutions can mitigate these challenges by preventing errors, improving efficiency and enhancing profitability.

Tim Hay-Edie

Head of Technical Pre-Sales,

Virtualstock

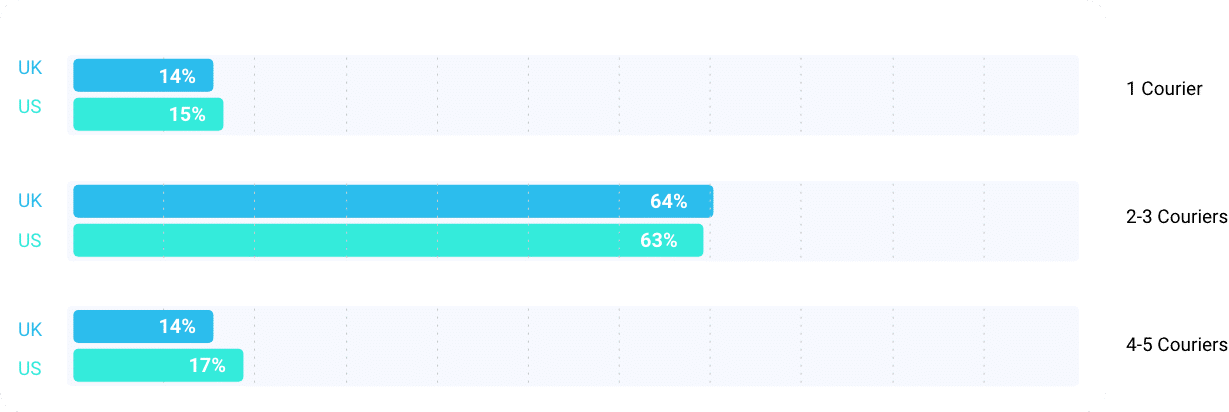

7. Most retailers aren’t connected to enough shipping couriers

Retailers in the US and UK have a similar approach to shipping, with 63% and 64% respectively connecting with two to three shipping services. Our research shows that companies generating higher revenues tend to engage with more shipping services.

For instance, 34% of US firms with revenues exceeding $10M partner with four or more shipping providers. Scaling up the number of shipping partners can be an effective strategy for retailers aiming to increase revenues.

Takeaway: Expanding your portfolio of shipping partners can offer competitive advantages by improving logistics efficiency, broadening delivery options and potentially driving higher revenue.

How many different shipping courier services are integrated into your logistics operations?

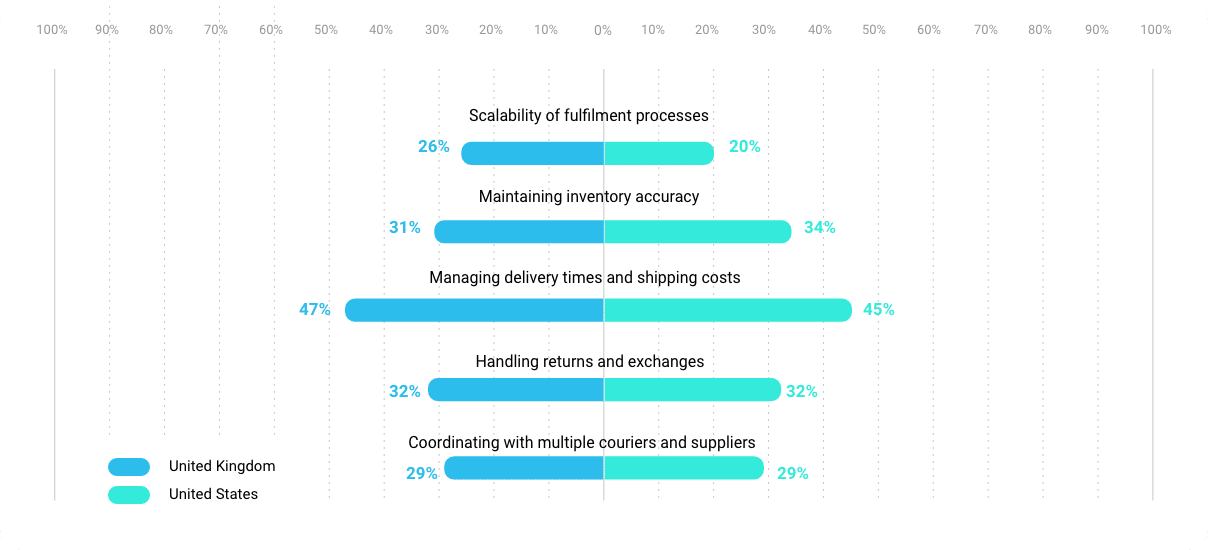

8. Delivery times and costs are the #1 fulfillment challenge

Order fulfillment can pose significant challenges, especially during periods of rapid growth. A large number of retailers (47% in the UK and 45% in the US) said that managing delivery times and shipping costs was their primary challenge when order volumes surge.

The next set of major challenges, cited by about a third of respondents, included handling returns/exchanges and maintaining inventory accuracy. As revenue increases, it's clear retailers find it difficult to scale fulfillment, keep accurate inventory and coordinate with multiple couriers or suppliers.

Takeaway: As a retailer grows, so does the complexity of its operations. Efficient management of delivery times, shipping costs, returns, exchanges, and inventory accuracy becomes crucial. Investing in robust supply chain management systems and processes can help address these challenges and support sustainable growth.

What are the main challenges you have in fulfilling orders efficiently as volume increases?

9. Retailers still use spreadsheets to track product listings

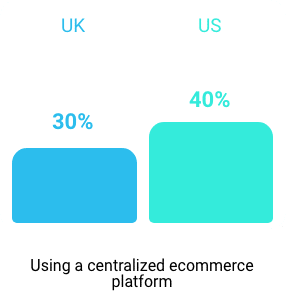

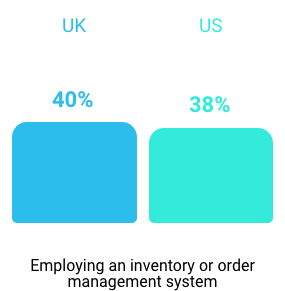

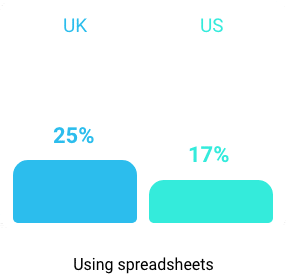

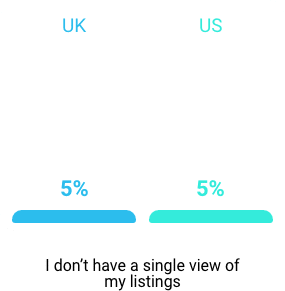

Many retailers invest in a centralized ecommerce platform or an order management system to maintain a unified view of products across sales channels. In the UK, 40% utilize an inventory/order management system, while in the US, 40% prefer a centralized platform.

A considerable percentage still use spreadsheets for this purpose: 25% in the UK and 17% in the US. While spreadsheets and disconnected technological systems present scalability challenges, integrated and automated systems provide enhanced possibilities for growth.

Takeaway: To ensure scalability and efficient product visibility across all sales channels, retailers should consider investing in connected and automated systems over traditional methods like spreadsheets.

What is your main method of maintaining a single view of your product listings across sales channels?

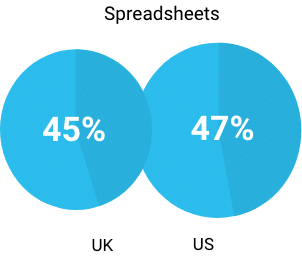

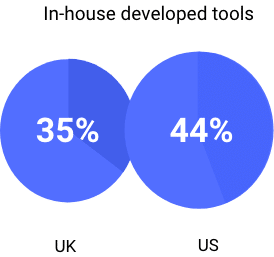

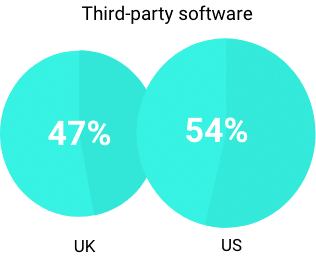

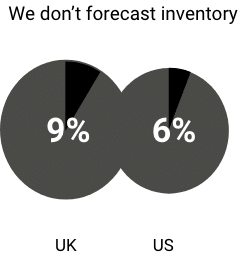

10. Nearly half of retailers use spreadsheets to forecast inventory

A significant number of retailers, nearly half from both the UK (45%) and the US (47%), rely on spreadsheets for inventory forecasting. Only a slightly higher percentage use third-party software (47% in the UK and 54% in the US).

In the UK, the use of spreadsheets remains relatively steady across different retailer turnovers, with 44% of those with a turnover between £10M to £50M using them. In the US, the scenario varies, with smaller firms using spreadsheets the least (29%), compared to 60% of retailers with a $10M to $50M turnover.

Takeaway: Many businesses use spreadsheets for online inventory forecasting, but they aren't the most efficient solution, especially for larger firms. By investing in inventory forecasting software, firms can enhance both their forecasting accuracy and efficiency, which will foster better operational decisions and growth.

Which tool(s) do you use to forecast inventory?

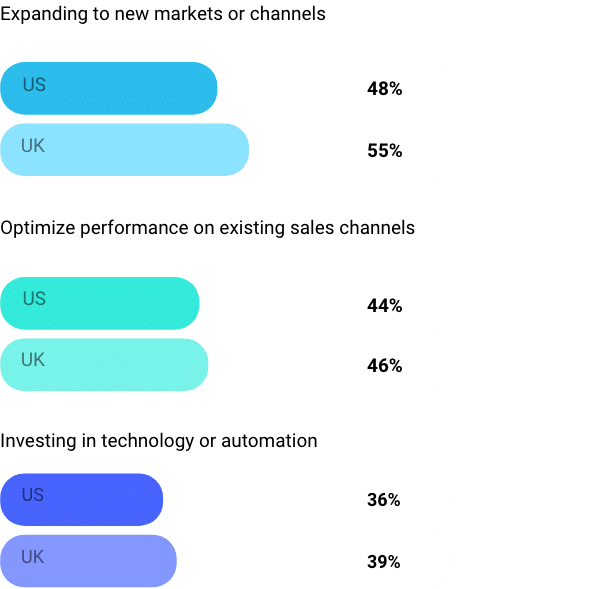

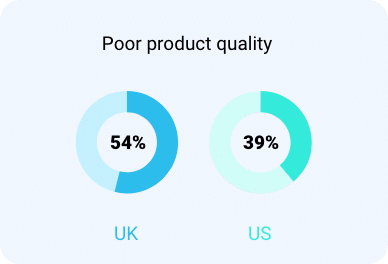

11. Expanding to new markets and channels is the number one goal

In 2024, breaking into new markets and channels is the top goal for retailers, with 48% in the UK and 55% in the US prioritizing this. Sales channel optimization is the second biggest focus, identified by 44% of UK retailers and 46% of US retailers.

Approximately two-fifths of retailers (36% in the UK and 39% in the US) plan to invest in technology and automation. Other key areas of focus include reliable commerce operation management, sustainability and connecting with more warehouse and fulfillment partners.

Takeaway: To succeed in 2024, retailers should consider centralizing their systems and investing in connectivity and automation. These strategic moves can help them efficiently break into new markets, optimize sales channels and streamline logistics.

What are your top business priorities for 2024?

Consumers want

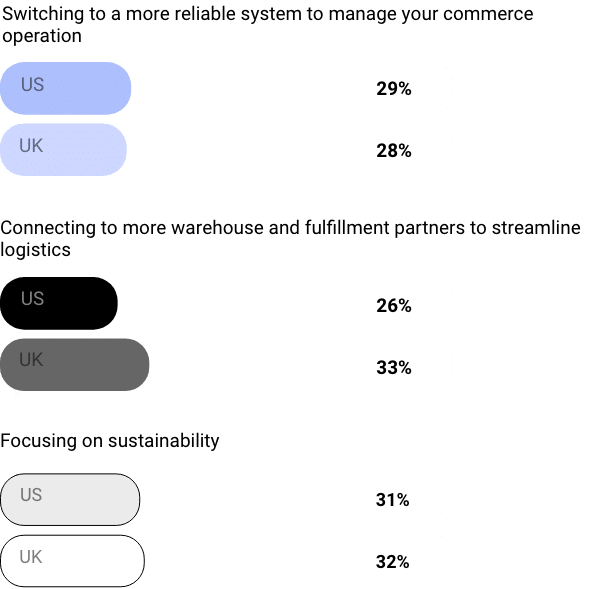

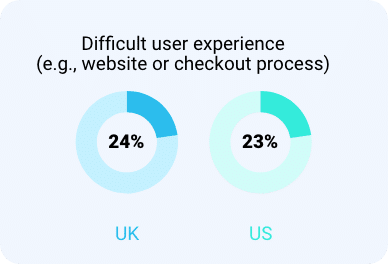

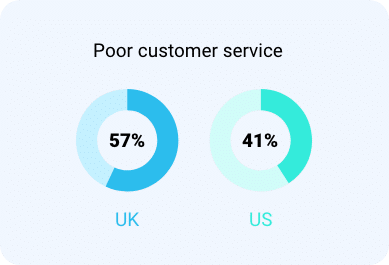

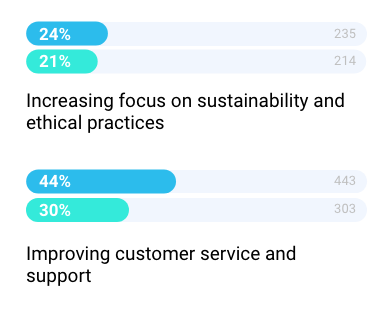

1. Customer service is key to a positive experience

Customer service (49%) and product quality (46%) are the leading contributors to a positive customer experience across all ages and genders in both the UK and the US, particularly among older demographics. However, beneath these primary demands, customers’ needs vary across their purchasing journey. These specific requirements, reliant on seamless commerce operations, include hassle-free online experiences, quick shipping, easy returns and smooth online interactions.

Takeaway: To enhance customer satisfaction in 2024, businesses should focus not only on delivering superior customer service and product quality but also ensure a seamless, frictionless end-to-end customer journey.

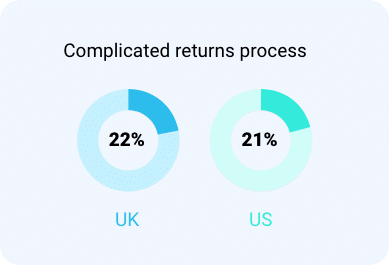

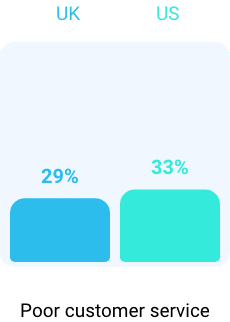

Which of the following elements are most influential in whether you have a negative customer experience?

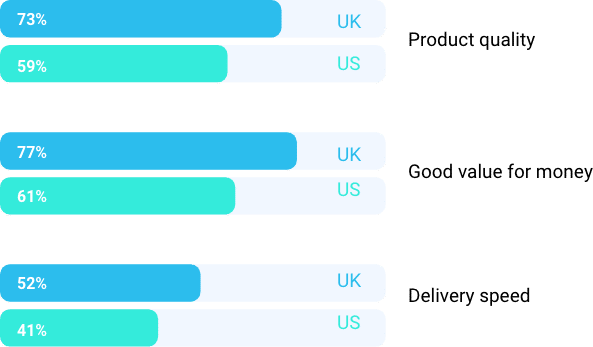

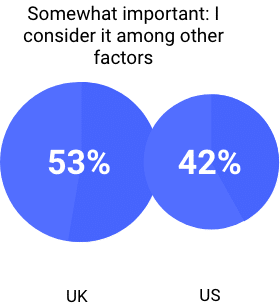

2. Quality, value and price are key to repeat purchases

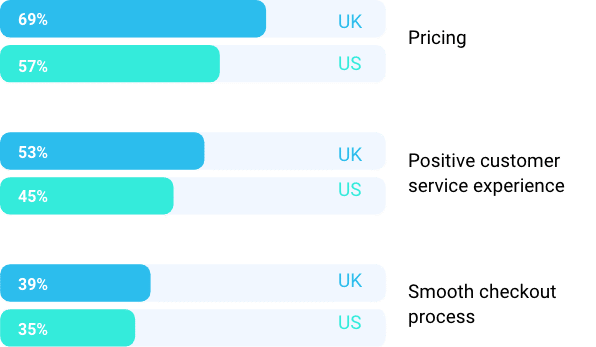

The decision of consumers to make repeat purchases hinges significantly on factors such as the quality and value of the product, as well as its price. These factors are slightly more influential for UK consumers, with 69%-73% stating they would repurchase based on these criteria, compared to 57%-61% in the US.

Around half of consumers (53% in the UK, 45% in the US) cite a positive customer experience as a crucial factor. Additional aspects influencing repeat purchases include quick delivery, diverse product range, seamless checkout, and ethical business practices.

Takeaway: To drive repeat purchases, retailers must prioritize product quality, value and competitive pricing. Focusing on customer experience, efficient delivery, product variety, seamless checkout and ethical practices can further boost customer loyalty. However, achieving these goals requires robust oversight and control of back-office operations.

What factors, if any, influence your decision to become a repeat customer?

3. Shoppers prefer buying from online marketplaces

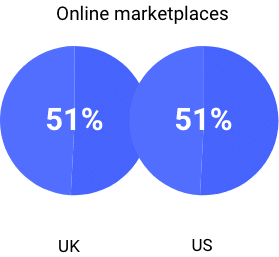

Ecommerce platforms such as Amazon and eBay remain the favored choice for online shoppers, with 51% of surveyed individuals from the UK and US expressing a preference for these marketplaces. Direct-to-consumer (D2C) brand websites are the second most preferred option, chosen by 24% of UK and 16% of US shoppers.

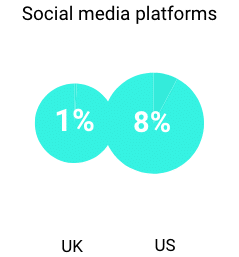

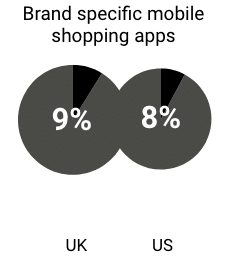

While other channels like social media platforms, retailers' mobile apps, and online marketplace mobile apps do not enjoy the same popularity overall, they are frequented more by younger consumers, particularly those in the US. For instance, 8% of US survey respondents prefer to shop on social media platforms such as Facebook Marketplace, a figure that drops to just 1% among UK respondents.

Takeaway: Retailers looking to reach more customers need a multichannel strategy that includes online marketplaces, their own website and a social media presence.

What is your preferred channel for making an online purchase?

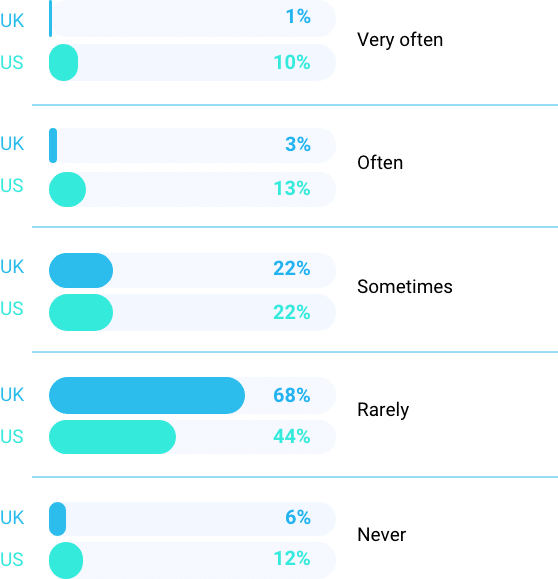

4. Almost half of US consumers experience issues buying online

A total of 45% of US respondents sometimes, often or very often face issues while shopping online. This is in contrast to just over a quarter (26%) of UK shoppers.

Consumers aged 25-34 from both countries are the ones most likely to encounter negative online shopping experiences, with 55% of male US shoppers regularly encountering difficulties. It’s crucial for retailers to efficiently handle complexities during expansion to avoid negative customer experiences.

Takeaway: Fulfillment is a huge challenge, more so in the US than UK. Ecommerce businesses need to make sure they have the right ecosystem of tech and logistics partners in place to manage this and improve the customer experience.

How often do you experience issues with your purchase when ordering a product online?

Shipping errors come from many places — typos, improperly packed items or mishandling to name a few. Ensuring safe delivery involves accurate order processing through shipping software, using appropriate packaging, choosing reliable carriers, and maintaining open communication with customers. Offering additional parcel insurance options can also bolster buyer confidence.

Krish Iyer

Vice President, Strategic Partners & Industry Relations, Auctane

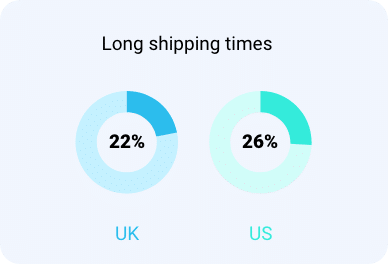

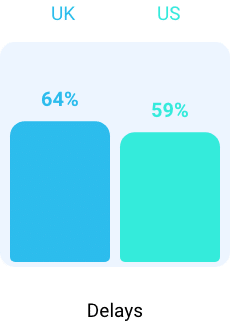

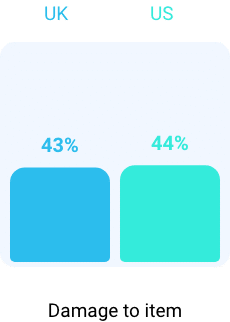

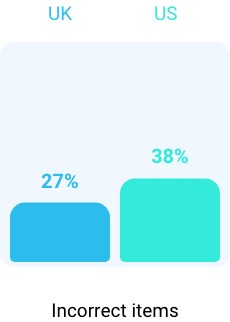

5. Shipping delays and damaged items are consumers’ biggest complaints

Shipping delays top the list of consumer grievances, affecting a significant number of consumers in both the UK and US. Approximately two-thirds (64%) of UK shoppers and 59% of US shoppers have experienced late item deliveries.

The second major concern for consumers is receiving damaged items, with over two-fifths of shoppers (43% in the UK and 44% in the US) having received faulty goods.

Takeaway: Ensuring damaged goods do not leave the warehouse is paramount, making inventory visibility and quality control critical steps in the fulfillment process. Once items are dispatched, having an efficient operational setup becomes crucial to mitigate the risk of delays. Implementing automated order routing can significantly aid in managing such issues, enhancing the overall efficiency of the operation.

Connectivity is at the heart of what Linnworks brings to the retailer, from both an upstream and downstream perspective.

Upstream, we connect retailers to marketplaces, which presents a fantastic opportunity for them to expand their market potential and increase their target addressable market. This connectivity enables growth.

Downstream, as retailers strive to deliver and enhance the customer experience, we offer connectivity through our shipping and logistics partners. This allows them to refine how they deliver goods to customers.

So, with Linnworks, retailers achieve two major objectives: growth through marketplace connectivity and operational efficiency through downstream connectivity.

Georgia Leybourne

CMO, Linnworks

What issues have you experienced when purchasing online?

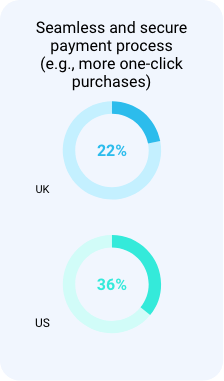

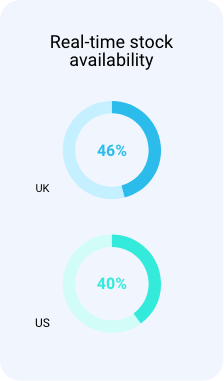

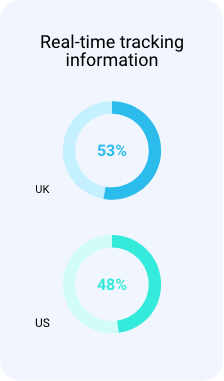

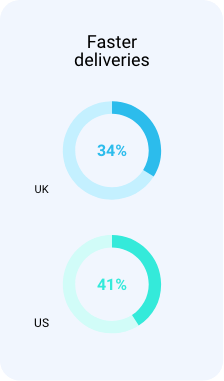

6. Technology is key to a better online experience

A significant number of individuals surveyed in the UK and US feel that technology can play a vital role in enhancing online shopping experiences. They specifically highlight the need for features such as real-time order tracking and immediate visibility of stock levels. More seamless payment methods and supply chain trasparency were also raised.

Takeaway: This data underscores the importance of leveraging technology to provide real-time updates and improve delivery speed in ecommerce. It also reveals a growing consumer demand for transparency in supply chains, suggesting that retailers who invest in these areas can significantly enhance their customer experience.

How would you like to see technology improve your online shopping experience?

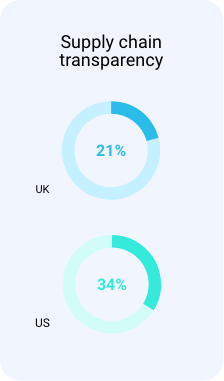

7. Shipping costs need to be clear and upfront

A significant majority of consumers (69%) expect retailers to be transparent, disclosing delivery costs and times early in the process to prevent unexpected surprises. Similarly, 68% of consumers expressed a desire for a quick and straightforward checkout process.

Clear information about return policies is crucial as it often influences consumers’ purchasing decisions.

Takeaway: Retailers should focus on transparency, speed, and simplicity. Sharing shipping details early, streamlining checkout and clarifying returns can boost customer satisfaction and sales. Recognizing these factors' impact on consumer behavior is crucial.

Which features do you consider essential to make a smooth experience during online checkout?

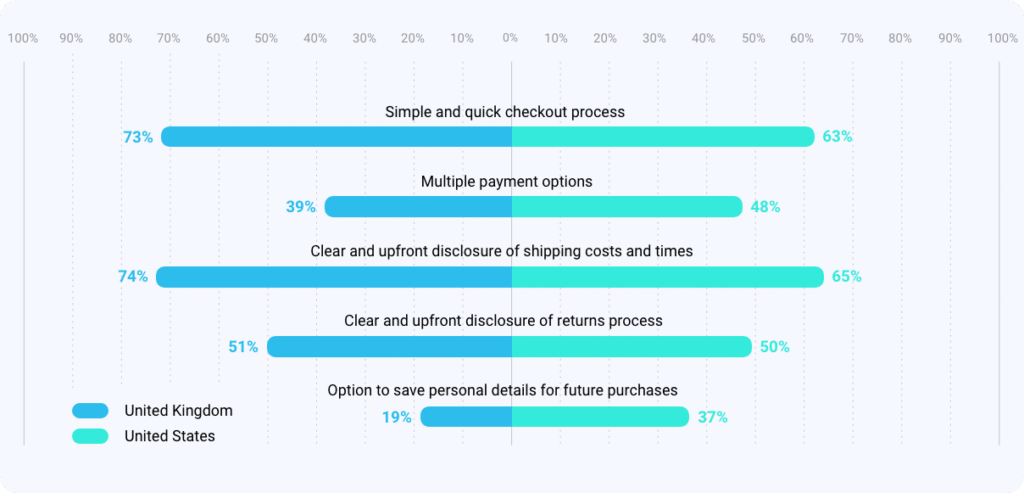

8. Consumers want free shipping

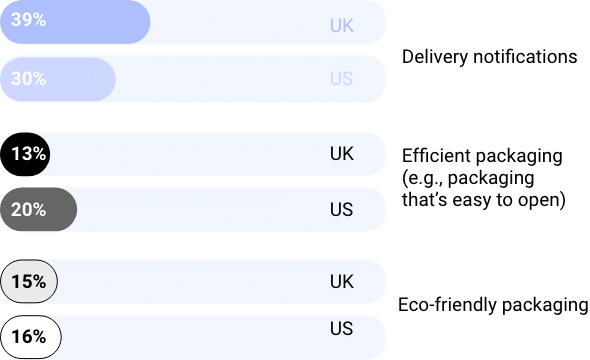

When it comes to delivery, the majority of consumers named free shipping as their biggest expectation. Dig a little deeper, however, and measures designed to combat delivery anxiety, such as parcel tracking and delivery notifications, prove to be just as important. Interestingly, the demand for same-day or next-day delivery ranks lower when averaged across both countries.

Takeaway: Can smaller businesses build free shipping into their costs that doesn't erode their margins? That's the challenge. Beyond that, giving consumers visibility of their product's journey in real-time is becoming increasingly important.

When it comes to deliveries, what are your primary expectations?

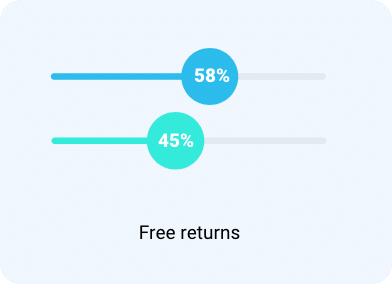

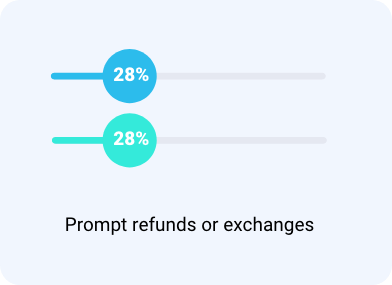

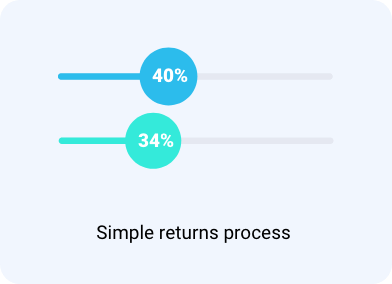

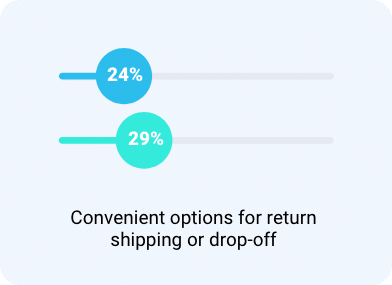

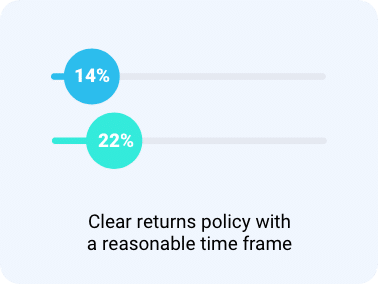

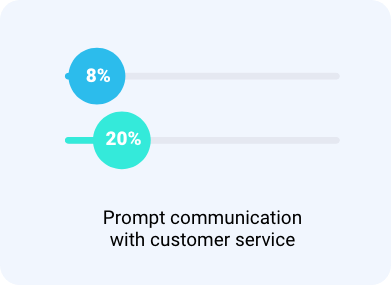

9. Consumers want free, simple returns

It's not just free shipping consumers want. They also expect free returns, along with a simple returns process and quick refunds or exchanges. This is particularly important for UK consumers aged 18-24, with 82% considering it crucial.

Efficiently managing the reverse supply chain can be challenging without fully integrated order and inventory management systems.

Takeaway: To meet consumer expectations and enhance customer satisfaction, retailers should offer free, simple return processes and ensure prompt refunds or exchanges. Especially for younger demographics, these factors can significantly influence purchasing decisions.

When it comes to deliveries, what are your primary expectations?

Free returns are a double-edged sword. They attract customers — but the costs can be significant. Consider offering multiple returns options, integrating exchanges into your returns process or partnering with returns service providers that can bring processing costs down.

Krish Iyer

Vice President, Strategic Partners & Industry Relations, Auctane

10. Sustainability is now a major reason to buy

Sustainability is a major consideration for consumers, with 68% of UK and 72% of US shoppers considering sustainable retail practices important. Male US shoppers and female UK shoppers value sustainability the most. The age group that prioritizes sustainability the most is 25-34 in both countries, with 96% of this demographic in the US rating sustainability as important.

Takeaway: With the majority of consumers placing high importance on sustainability, retailers must prioritize sustainable practices to attract and retain customers. The market clearly signals a shift towards more conscious consumption, indicating that sustainability is not just a trend but a long-term expectation from consumers.

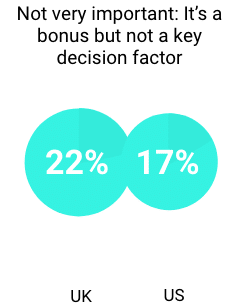

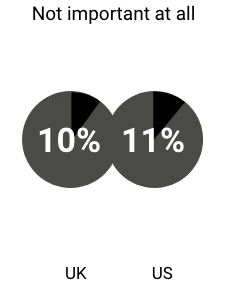

How important is it to you that retailers adopt more sustainable practices?

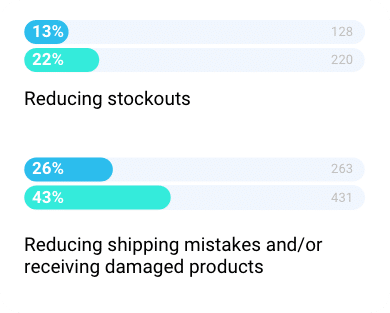

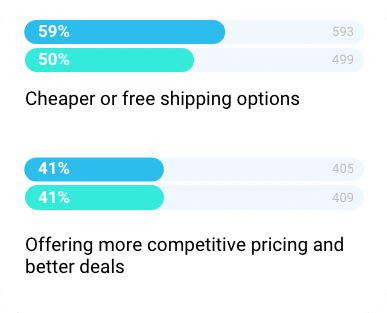

11. Consumers’ biggest pain point? Shipping costs

Cheaper or free shipping tops the wishlist for UK and US shoppers in 2024, with 50% of US and 59% of UK consumers citing shipping costs as a major concern. Young and old age groups are most worried about these costs. UK shoppers, especially men, believe reduced shipping costs would enhance their shopping experience.

Other areas for improvement include competitive pricing, better deals, improved customer service and reducing shipping errors and product damage.

Takeaway: To enhance customer satisfaction, retailers should focus not only on offering free or cheaper shipping but also improving pricing strategies, customer service, and reducing shipping errors. Managing shipping costs effectively requires integrating multiple delivery partners and maintaining clear visibility of cost-related KPIs.

What do you want to see online retailers doing more to improve your shopping experience with them?

Connectivity means stability in 2024 and beyond

The modern customer demands an easy, speedy shopping experience paired with top-tier products and service. But as retailers expand, fulfilling these expectations becomes more challenging.

The key to overcoming these challenges? Connectivity.

By implementing a connected commerce operation, ecommerce retailers can:

- Improve inventory visibility across their warehouses and channels

- Automate inventory management and order processes

- Connect to new marketplaces and shipping couriers easily

- Improve warehouse quality control

- Manage listings, inventory and fullfilment - all from one centralized platform

As we venture into 2024 and beyond, connectivity will serve as the cornerstone for stability in ecommerce. By capitalizing on connected commerce, online retailers can establish an infrastructure empowers them to scale rather than holds them back.

in 2024

1. Spreadsheets and a patchwork of tech systems will only get you so far

Our research shows that retailers achieving the highest levels of growth have invested in connectivity, visibility and automation.

Takeaway: It’s not possible to scale without a unified, real-time view of your operation. To grow sustainably, businesses need to build a connected tech ecosystem.

2. Bad habits and challenges scale with your business

Many retailers are still using custom-built or manual integrations to connect to marketplaces and shipping couriers, while forecasting or keeping track of listings using spreadsheets.

Takeaway: Many entrepreneurs wait too long to change. If you’re not solving operational challenges – mistakes, spiraling costs, having to work weekends – they’re only going to get bigger.

3. Multichannel retail is critical to success

Our survey reveals that the higher a retailer’s turnover, the more marketplaces and channels they are likely to target.

Takeaway: 70% of customer searches now begin on marketplaces or social media. The key is how you manage multichannel in a way that mitigates complexity and risk.

4. Connectivity provides stability

The majority of retailers told us they now invest in systems automation and visibility, but there is still much work to be done.

Takeaway: To scale without adding risk or cost, a retailer needs to connect and automate every aspect of their ecommerce operations, from the moment an order is placed right through to delivery.

5. Invest in the right tech, at the right time

Our survey reveals that the higher a retailer’s turnover, the more marketplaces and channels they are likely to target. Retailers number one priority for 2024 is breaking into new markets and channels, but attempting to achieve growth without taming complexity is not sustainable.

Takeaway: Investing in a Connected CommerceOps platform like Linnworks allows you integrate with hundreds of marketplaces, sync your inventory and order data in one place and put your ecommerce operation on autopilot.

Connect your commerce ops with

We connect…

your back-office systems to an expansive network of global marketplaces, direct-to-consumer platforms, shipping providers and third-party logistics partners using powerful integrations. This enables you to be where your customers are, effortlessly enabling you to thrive on every channel. By unlocking the true power of a connected commerce operation with Linnworks, you can achieve unrivaled ecommerce accuracy.

We automate…

your ecommerce operations, including inventory management, order processing and multi-channel synchronization. This automation increases accuracy, speed and efficiency of your online business, enabling you to fulfill large volumes of customer orders quickly and accurately.

We centralize…

your operations using our unified dashboard, which consolidates data from multiple sales channels to create a single view of listings, inventory, orders and shipments. We unify this data, consolidating it into a single, accessible repository.

We deliver…

a scalable solution that grows with your business, accommodating new product lines, sales channels and increased order volumes. We also use data analytics to help your business scale, platform integration to grow your ecosystem, customizable plans to cater for your business needs regardless of your size, and automated processes which handle an increasing volume of orders and products as you grow.