Choosing the right inventory costing method: FIFO, LIFO, Weighted Average, & Specific ID

The inventory costing method you select is one of the most critical financial decisions for your business.

This single choice directly impacts reported profitability, tax liability, cash flow, and overall inventory valuation, influencing everything from your pricing strategy to your company’s valuation. Making the wrong choice can distort your financial health and lead to flawed business decisions.

In this guide we dive deep into the four main inventory costing methods and provide a practical framework to help you choose the right approach.

What is inventory costing? (and why it matters)

Inventory costing is how a business assigns value to its stock. This value directly affects the cost of goods sold, gross profit, taxes, and financial reporting. Inventory costs are therefore at the core of financial accuracy, shaping both short-term cash flow and long-term strategy.

In ecommerce, the impact of accurate inventory costing is multiplied. Multi-channel operations, fluctuating supplier costs, volatile inventory, and different tax jurisdictions make having the right inventory costing essential. When not tracked correctly, hidden inventory costs can erode your profit margin. Errors in calculating ending inventory also add another layer of risk, leading to overstated or understated profits.

The inventory costing method you choose will influence pricing strategy and ensure consistency in financial reporting across platforms, including how ending inventory is valued.

For example, if you sell 100 T-shirts purchased in separate batches at different prices, the way you assign costs to those sales (whether by FIFO, LIFO, or average cost) determines both your margin and your tax bill. Inaccurate assignment of inventory costs in such cases can mislead decision-making and distort true profitability.

Clear visibility into the cost of goods sold helps you compare profit across batches and track inventory value at any point in time. Without accurate ending inventory, these comparisons lose reliability.

The 4 main inventory costing methods

There are four main inventory costing methods (FIFO, LIFO, Weighted Average, and Specific ID).

Each method differently calculates the cost of goods sold and inventory value.

However, before diving into the methods, it’s important to understand the two systems for tracking inventory—perpetual and periodic—as each system can change the results.

A key concept: Perpetual vs. Periodic Systems

Your inventory costing method does not operate in a vacuum; it functions within your larger inventory tracking system.

Understanding the two primary systems—perpetual and periodic—is essential because your choice of system can directly affect the final calculations for your cost of goods sold and inventory value.

- Perpetual: Updates inventory and cost of goods sold in real time with every sale or purchase. This is the default for most ecommerce platforms and inventory software.

- Periodic: Updates inventory and COGS only at set intervals (like month-end or year-end), based on physical counts and batch calculations.

- Impact: Some costing methods (e.g. FIFO, Specific ID) give the same results under both. Others (like LIFO and Weighted Average) can produce different numbers depending on whether costs are updated continuously or in batches.

Now that you know how the two systems shape results, we can look at how these inventory costing methods work in practice.

FIFO (First-In, First-Out)

The FIFO inventory costing method assumes the first units purchased are the first units sold.

Example:

You first buy 100 units at $10, then 100 more at $12.

If you sell 100 units, FIFO uses the first batch. Therefore, cost = $10 each.

Pros: Matches real-world flow of perishables, reduces waste, aligns costs with current market prices, and offers more transparent gross profit reporting. It also provides visibility into direct costs and supports sustainable growth with higher profit margins during stable markets.

Cons: Results in higher taxes during inflation because older, cheaper costs are matched against current revenues.

Best Fit: Food, fashion, and fast-moving consumer goods.

LIFO (Last-In, First-Out)

The LIFO inventory costing method assumes the most recent purchases are sold first.

Example:

You first buy 100 units at $10, then 100 more at $12.

If you sell 100 units, LIFO uses the latest batch. Therefore, cost = $12 each.

Pros: Lower taxable income during inflation, matches sales to current costs and recent revenues, and can temporarily boost gross profit margins if prices fall. This also helps track variable costs in inflationary environments, making it attractive for businesses where inventory costs rise quickly and tax advantages are critical.

Cons: Financial statements may not reflect true inventory value.

Best Fit: Durable goods, industries in inflationary markets where tax savings are prioritized.

Note: LIFO is more commonly used in the US which complies with the Generally Accepted Accounting Principles (GAAP) standards. However, its use isn’t permitted under the International Financial Report Standards (IFRS). The IFRS is an accounting standard required for publicly listed companies in over 140 jurisdictions (not including the US).

Weighted Average Cost

The Weighted Average Cost (WAC) method, also known as the average cost method, uses the average cost of all units available for sale.

Example:

You buy 100 units at $10 and 100 units at $12 (total 200 units, $2,200).

Average cost = 2,200 ÷ 200 = $11 each.

If you sell 100 units, cost = 100 × $11 = $1,100.

Pros: Simplifies costing, ensures consistent margins, smooths out price fluctuations, and helps forecast steady gross profit. Because of this averaging effect, businesses can avoid wild swings in reported inventory costs during volatile pricing cycles.

Cons: Less precise than FIFO or LIFO, may not reflect actual flow of goods. Some managers find it harder to pinpoint specific drivers of inventory costs under this method.

Best Fit: Large volume businesses such as commodity ecommerce or bulk retailers.

Note: Some businesses use a moving average variation of the weighted average cost method, a form of average costing where the cost is recalculated after each purchase. This approach is common in high-volume environments with frequent price changes as it ensures inventory value and gross profit projections are always aligned with the latest purchase data.

Specific Identification (Specific ID)

Specific ID assigns the exact purchase cost to each item sold.

Example:

If a particular designer handbag costs $1,500, its sale records that exact cost, and the unsold stock retains its precise inventory value.

Pros: Provides precision in costing and profit analysis. It gives business owners unmatched clarity into inventory costs by tying each sale directly to its purchase value.

Cons: Time-consuming and requires detailed tracking. Managing specific inventory costs item by item often requires advanced systems like RFID.

Best Fit: Luxury goods, unique products, or custom orders.

Note: This method often relies on tools like barcoding or RFID for accuracy.

Comparison Table: FIFO vs LIFO vs WAC vs Specific ID

| Inventory costing methods | Example (100 @ $10, 100 @ $12, Sell 100) | Pros | Cons | Compliance | Periodic vs Perpetual |

| FIFO | COGS = 100 × $10 = $1,000 | Matches market prices, reduces waste | Higher taxes in inflation | Accepted under IFRS & GAAP | Results identical under both systems |

| LIFO | COGS = 100 × $12 = $1,200 | Tax savings in inflation | Distorts financials | Accepted under US GAAP only, banned under IFRS | Results can differ between systems |

| Weighted Avg | Avg = ($1,000 + $1,200) ÷ 200 = $11 COGS = 100 × $11 = $1,100 | Simple, consistent margins | Less precise | Accepted under IFRS & GAAP | Perpetual = moving average after each purchase Periodic = average at interval |

| Specific ID | Each item tracked individually | Highest accuracy | Labor-intensive | Accepted under IFRS & GAAP | Same under both, depends on tracking tech (RFID/barcodes) |

Now that you’ve seen how each method works, it’s clear that each choice involves trade-offs—for example, balancing potential tax advantages against the accuracy of your financial statements. Selecting the right approach is a key strategic decision.

The next section provides a step-by-step guide to help you choose the method that best fits your products, market, and financial goals.

Choosing the right inventory costing method

Selecting the best inventory costing method for your business is a critical decision. The right inventory method will align with your operations and financial strategy, while the wrong one can lead to tax inefficiencies and a distorted view of your profitability. It also determines how your ending inventory will be presented on the balance sheet, which directly shapes investor confidence.

Use this framework to evaluate which method best supports your business.

1. Analyze your product type

The physical nature of your inventory is the most important initial filter. Different products demand different costing approaches to minimize waste and accurately reflect value. Choosing the right inventory costing methods ensures that this alignment between product type and cost tracking is maintained from the start.

- Perishable or Trend-Based Goods: For businesses selling products with a limited shelf-life, like food, cosmetics, or fast-fashion apparel, the First-In, First-Out (FIFO) method is the logical choice. It assumes the first items you purchase (older inventory) are the first ones you sell, matching the natural flow of inventory and reducing the risk of stock becoming expired or obsolete.

- Unique or High-Value Items: If you sell distinct, high-ticket items like luxury goods, custom furniture, or automobiles, the Specific Identification method is essential. This method tracks the exact cost of each individual item from purchase to sale. It provides the most precise profit analysis possible, which is crucial when the cost of a single item is significant. Because of this precision, Specific Identification is one of the inventory costing methods often used in industries where accuracy per unit is critical.

- Non-Perishable, Homogeneous Goods: For businesses selling durable goods with a slower turnover, Last-In, First-Out (LIFO) or Weighted Average Cost (WAC) are viable options.

Ask yourself: Is my inventory perishable, fast-moving, durable, or unique?

2. Evaluate market and pricing conditions

Your total inventory cost is rarely static. How you account for fluctuating current costs will directly affect your reported profits and tax obligations. If market prices are volatile, the calculation of ending inventory becomes even more important for accuracy.

- In Times of Rising Prices (Inflation): The LIFO method can offer significant tax advantages. By assuming the most recently purchased (and more expensive) items are sold first, you increase your Cost of Goods Sold (COGS), which lowers your reported profits and, consequently, your taxable income for the period. Conversely,

FIFO in an inflationary environment will result in a higher reported profit and a clearer picture of your inventory’s current market value. - In Times of Volatile Prices: If your supplier costs fluctuate frequently, the Weighted Average Cost (WAC) method can be highly beneficial. It smooths out price swings by creating a single, averaged cost for all your units. This simplifies pricing, stabilizes your profit margins, and makes financial forecasting more predictable.

Ask yourself: Are my supplier costs steadily rising, or are they highly volatile? The right inventory costing method in these conditions can be the difference between volatile financials and sustainable growth.

3. Align with your business goals

Your choice should reflect your company’s strategic priorities. Are you focused on short-term cash flow, or is long-term, stable reporting more important?

- Prioritizing Short-Term Tax Reduction: If your primary goal is to minimize your immediate tax liability (and you operate where it’s permitted), LIFO is the most effective tool during periods of inflation.

- Prioritizing Stable, Transparent Profits: If you value consistent margins and financial statements that accurately reflect current inventory value, FIFO or WAC are better choices. FIFO provides a transparent look at profitability, while WAC offers stability in pricing and margin management.

Ask yourself: Do I prioritize short-term tax savings or long-term financial stability and clarity? Ultimately, your inventory costing method should mirror the financial story you want to tell stakeholders and investors.

4. Ensure regulatory compliance

Accounting standards are not universal, and your choice of method may be limited by your location.

- IFRS vs. GAAP: LIFO is prohibited under International Financial Reporting Standards (IFRS), which are used in more than 140 jurisdictions worldwide. However, it is permitted under the Generally Accepted Accounting Principles (GAAP) in the United States. This is a critical distinction for businesses operating or selling internationally.

- Consult Professionals: Tax laws and inventory cost accounting requirements are complex. Before finalizing your choice, it is essential to consult with an accountant or tax advisor to ensure you are compliant with all relevant regulations.

Ask yourself: Which methods are legally permitted under my financial reporting standards?

5. Consider operational complexity

The resources required to maintain each method vary significantly.

- Simpler Methods: FIFO and WAC are generally easier to manage. FIFO follows a simple chronological logic, and WAC simplifies costing by using a single average price, reducing the need to track individual purchase batches.

- Complex Methods: Specific Identification is the most labor-intensive, as it requires tracking every single item individually. This often requires technology like barcoding or RFID systems to be managed effectively.

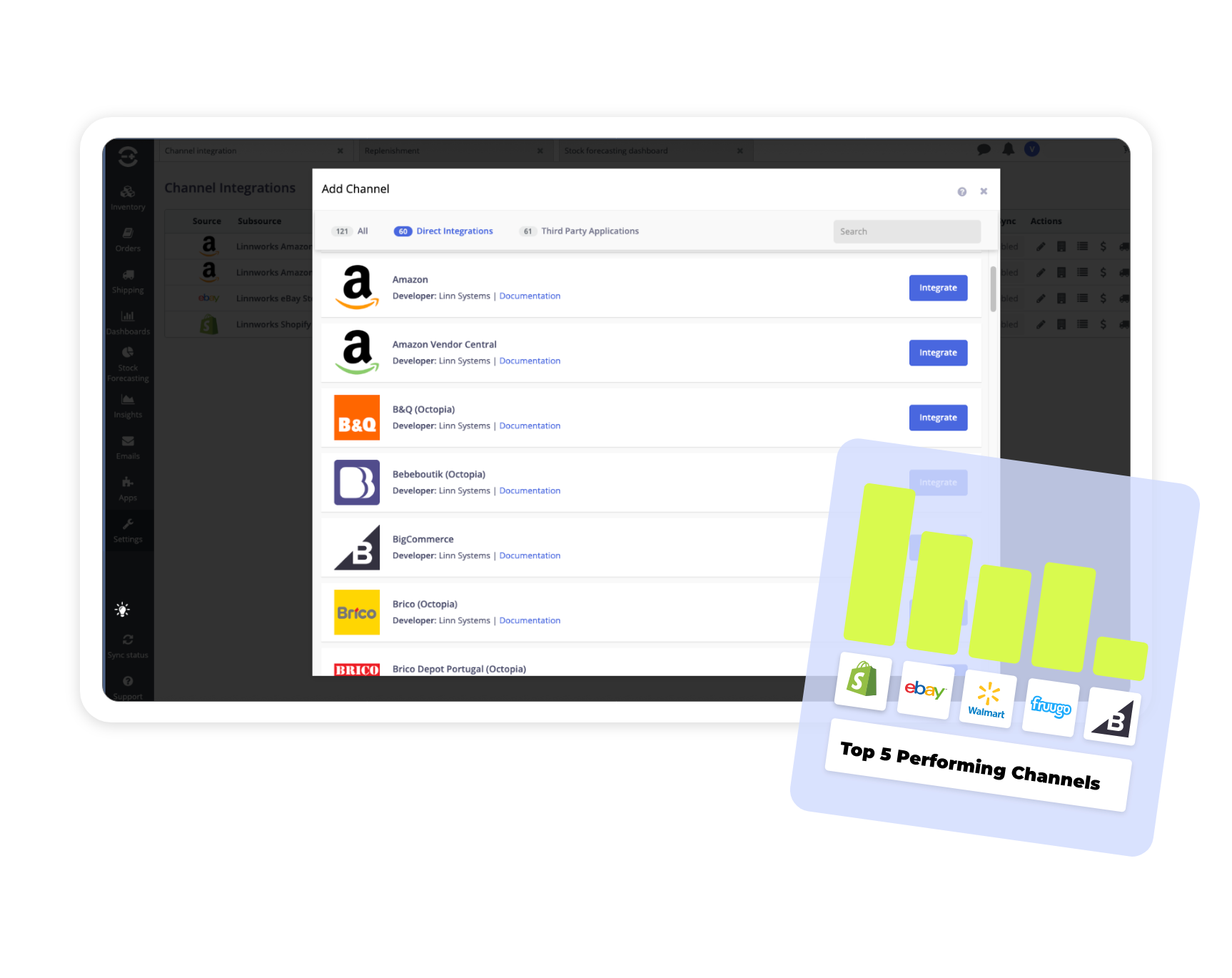

- The Role of Software: A modern inventory management system like Linnworks can greatly reduce this complexity by simplifying tracking of direct costs, indirect costs, and overall production costs. By automating the tracking of stock levels, costs, and sales across all your channels, these platforms make any costing method more manageable and ensure your data is always accurate.

Ask yourself: Do I have the team and tools to manage the complexity of this inventory costing method?

6. Maintain consistency

Once you choose a method, you should stick with it. Changing your inventory costing method frequently can distort your financial data, making it difficult to compare performance from one period to the next.

This can mislead investors, lenders, and your own management team. Furthermore, tax authorities often require a formal application process to change accounting methods, making consistency a practical necessity.

Ask yourself: Is this an inventory costing method I can commit to using for the foreseeable future?

The role of inventory management software

Effective inventory management and choosing the right inventory valuation methods directly affects profitability, taxes, and cash flow. The best choice depends on your products and financial goals. Accurate inventory costing methods also standardize how ending inventory is calculated, providing a single source of truth for financial reporting.

But manually applying these methods across multiple sales channels is often unmanageable and leads to costly errors. A structured framework can prevent margin erosion and reporting mistakes, but only if the chosen methods are applied consistently.

Linnworks centralizes your entire commerce operation into one platform. Customizable automation streamlines workflows, while real-time inventory sync nearly eliminates overselling. This keeps costing consistent across channels and ensures your chosen methods deliver accurate reporting and stronger profits.

To manage inventory from a single HQ and see how automation can transform your business, book a demo with Linnworks today.

See how automation can transform your business

Let Linnworks connect your entire e-commerce operation

FAQs

Weighted Average method is often considered the simplest, as it uses a single average price across units while keeping inventory value steady.

LIFO can reduce taxes, but only under US GAAP.

LIFO lowers taxable income in inflationary markets, while FIFO may result in higher taxes but more transparent inventory value.

Because it can distort reported profits and inventory values, regulators such as IFRS do not allow it.

Perpetual systems update costs continuously. Periodic systems calculate at set intervals. Some methods, like LIFO and WAC, can show different results depending on the system used. With WAC, the distinction lies in whether the average cost is recalculated at the end of a period or after each purchase.