Important Changes to Amazon Tax & Invoicing

If you’ve got an EU Amazon integration, Amazon will soon require an invoice to be attached to every shipped order in Seller Central. Every order needs to be accompanied by an invoice that Amazon keep hold of. Previously this was only a requirement for B2B orders, but now it affects every order you ship.

We understand that not every Linnworks user generates invoices, so we’ve added some new settings to your Amazon integration to make it easy to adapt to this change. These settings will behave differently if you’ve enrolled in Amazon’s VCS (VAT Calculation Service).

What is Amazon VCS?

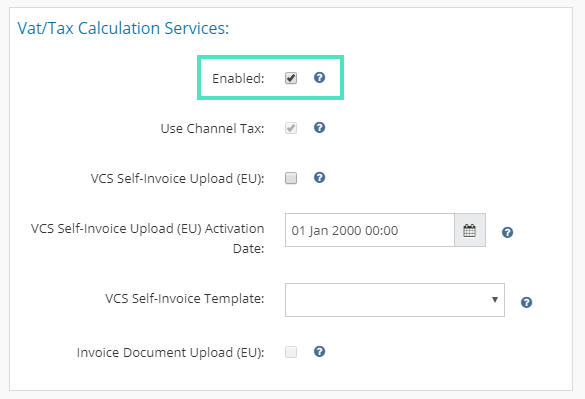

Amazon’s VAT Calculation Service tells Amazon to calculate the VAT for your orders. If you’re enrolled in this, then you need to tell Linnworks that VCS is enabled. You can do this by checking ‘Enabled’ in the VAT/VCS section of your integration.

How does this Affect Tax Calculations in Linnworks?

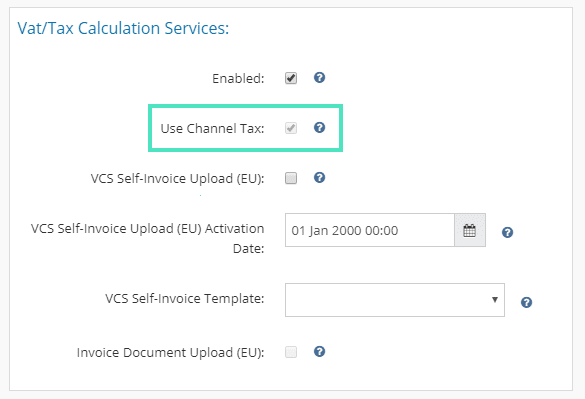

Because you’ve enrolled in VCS, Amazon are calculating tax on your orders for you, instead of Linnworks making the calculation itself. This is why the ‘Use Channel Tax’ option is automatically enabled when you enable VCS.

How does this affect invoices?

If you’re enrolled in Amazon VCS, then Amazon will be generating invoices and attaching them to orders for you, so neither you or Linnworks have to do anything.

What if I don’t want to use Amazon’s Invoice Design?

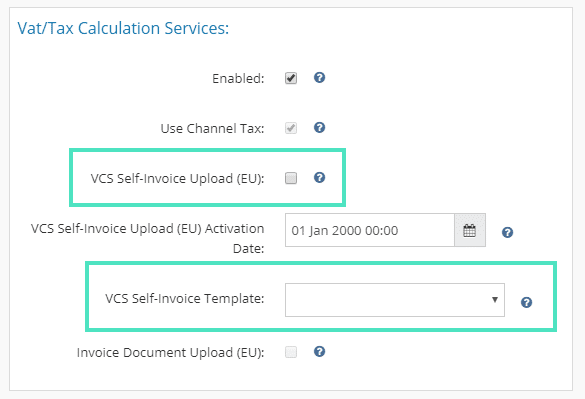

Your customers will be able to see and download this invoice. If you’re not a fan of the invoice design that VCS is using, you can upload your own! Just check the ‘Self-Invoice Upload’ option to tell Linnworks to override Amazon’s own invoice design with one from Linnworks. You can then choose an invoice template you want Linnworks to upload.

Do I still have to upload invoices if I’m not enrolled in Amazon VCS?

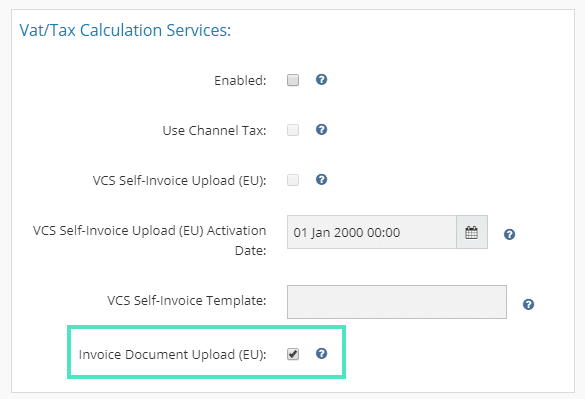

Yes. In order to stay compliant with Amazon’s new rules you will still have to upload a VAT compatible invoice with every order you process.

If you check the Invoice Document Upload option, We’ll automatically upload the conditional invoice you’ve designed in Linnworks for you. Remember to check your invoice templates and conditions before enabling this setting, to make sure you’re uploading an appropriate invoice.

Alternatively, you can upload an invoice manually to Amazon if you don’t want Linnworks to automatically do this for you.

We understand that these new requirements may be difficult to wrap your head around, so please reach out to our support team, and they’ll help you find what’s best for your business.